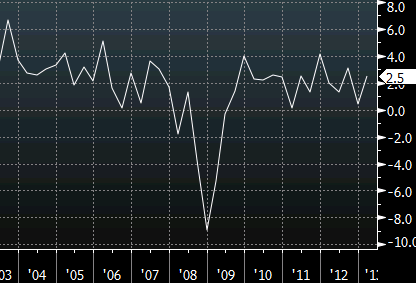

The results of the Q1 US GDP report, which is the first look at the quarter:

- US first quarter GDP (annualized) 2.5% vs 3.0% exp

- Fourth quarter 2012 annualized growth was 0.4%

- Personal consumption 3.2% vs 2.5% expected

- Core PCE inflation +1.2% y/y vs +1.1% expected

That’s a big miss for GDP and with Q2 looking even softer, hopes for 3% growth in 2013 are fading.

What’s even more surprising is that the consumer did some heavy lifting in the quarter with the biggest rise in spending since Q4 2010, with durable goods spending up a whopping 8.1% (consumers buy durable goods when they feel more secure in their finances). Inventory building also added a full percentage point to GDP but it wasn’t enough to overcome weakness elsewhere.

The main drag was trade due to a 5.4% jump in imports — the largest rise since Q3 2010. Exports were healthy at +2.9%, erasing a fall in Q4. Governments spending also fell 4.1%, adding to a 7% fall in Q4.

Business investment rose a so-so 2.1% following a 13.2% rise in Q4.