After spending yesterday in the clouds Alex shares his views on Money management and psychology.

You can read day 1 & 2 here.

Day 3: Money management, trader psychology, there are no shortcuts to success;

Trading is a risky business. How do we manage risk? Each time we take a trade we don’t put the full amount of our trading account but just a part of it, so we risk only this amount: we define the risk of the trade before actually starting it. So how much will we risk? It depends. My rule of thumb is to risk no more than 2% of my trading account on a single trade.

Let’s clarify everything with a practical example. I’ll assume 1 pip = roughly 1 EUR for clarity purposes, it’s not true but I want to make things as clear as possible. Suppose I have a 10,000 EUR trading account, I wouldn’t risk more than 2% of it so no more than 200 EUR on a single trade.

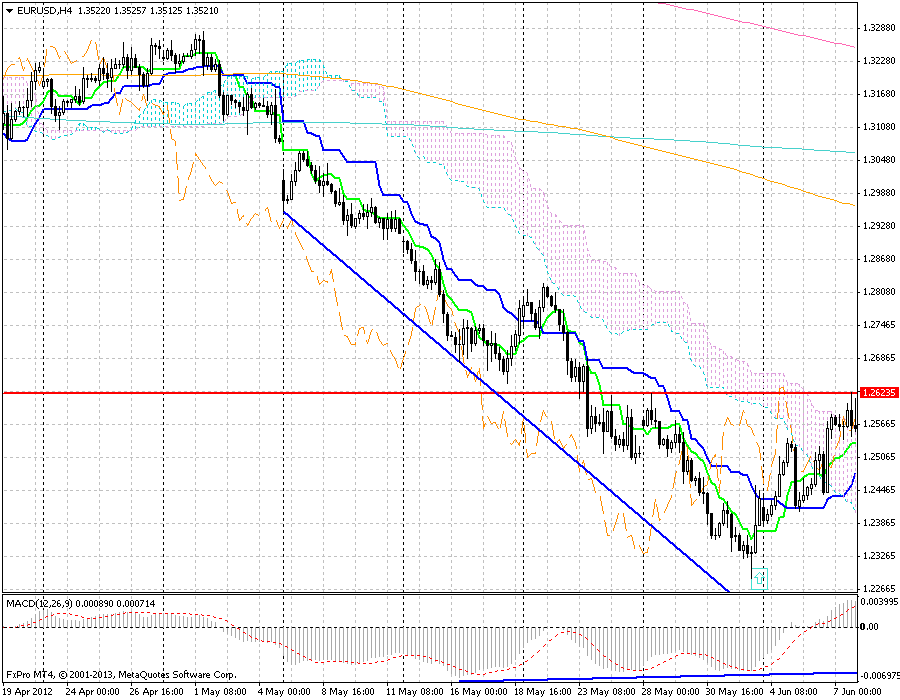

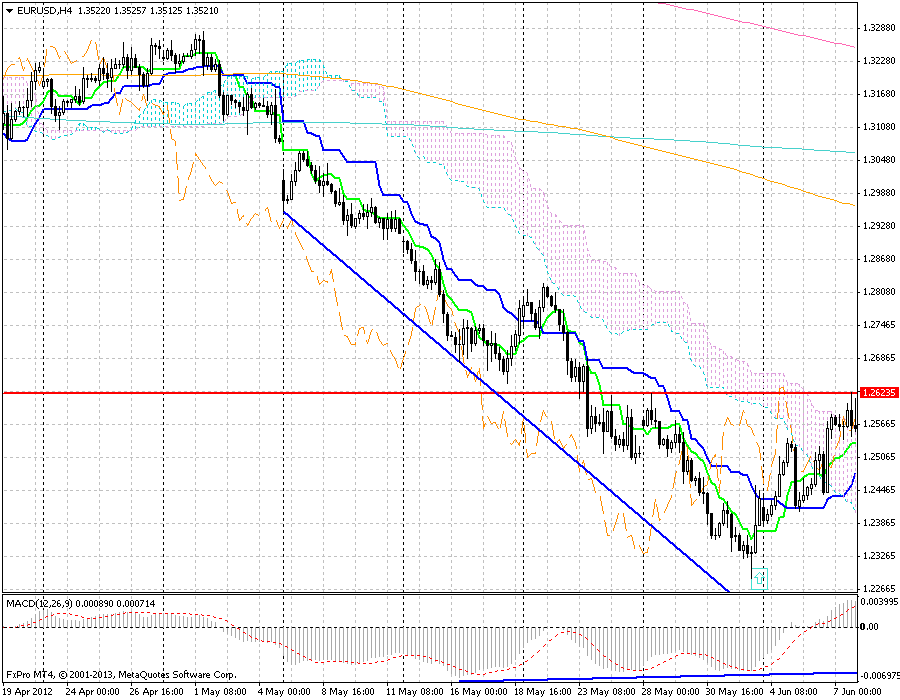

Now let’s look at the trade I want to take. It’s a buy the dips trade (dangerous!) on EUR/USD. EUR/USD has just completed a 4H bullish pin candle and in the days before I’ve spotted useful divergences between the falling trend and MACD. It’s a sound setup so let’s take a chance. Current price is 1.2335. The bottom of the candle is 1.2287. My experience suggests that I should put a stop-loss below the pin candle lower wick, say 1.2250. Mmmh it’s a round number, better 1.2245, it’s healthy to have some headroom before round numbers. Hey it’s a 90 pips stop! Ok it’s roughly a little less than 90 EUR with 0.1 mini lot, and I can risk 200 EUR. But this is a meager 0.2 lots, 2 mini lots! Not 5 lots or more!!! (please note that the mini lot is the smallest size tradable on my broker’s platform).

Just to reach breakeven EUR/USD should climb to about 1.2425… And this is a risk/reward 1:1, but I can see that the first heavy resistance is around 1.2600, so I’ll set the target at 1.2595. It makes a risk/reward of about 1:2.5! Good, I will have to stay in the trade for a while to reach my target. If I hit the target it’s something less than 520 euros profit. But I couldn’t hit it if something goes wrong.

OK let’s sell 1 mini lot at 1.2425 (so about 90 euros cashed) and trail my stop-loss to 1.2425: if EUR/USD takes 1.2595 I will make roughly another 170 euros with my mini lot left (about 350 euros total profit), if not, if it hits my trailed stop-loss I’ll get roughly 90 euros and the total profit of the trade will be about 180 euros. Better than a punch in the stomach. But everything could go wrong and this son of a mother goes instead to 1.2245 in a blink of an eye: 180 euros fall in the dustbin.

C’est la vie, it’s trading and trading is a risky business. When you enter such a trade you should think that you have thrown 180 EUR in the dustbin but you have still 9820 EUR left to keep on trading in the future, you’ll stay better while the trade develops and you should cope with the loss if the trade goes wrong. This is an example of money management.

Note that 5 lots with 90 pips stop is a risk worth 4500 Euros and almost half of my trading account in just one operation! The successful method should be: see if the trade is feasible, see is the reachable target justifies the risk with a risk/reward 1:2 or better, set the amount (lots or lot fractions) to be traded in function of the risk and then manage your trade. You could still blow your account but hey, you need 50 bad trades to blow it! Best risk / reward trades are when price is near a big support / resistance. Maybe in that in that case you only need a 25 pips stop-loss (they could be enough for say USD/JPY, but you should double it for say GBP/JPY), to cope with the currency oscillations and then you could risk roughly 0.8 mini lots and make 50 pips in order to have a R/R of 1:2… And the trend reversal could continue!

That’s why good traders keep their powder dry while waiting patiently for days or weeks for these setups coming, because they know they can risk not much and could gain a lot! The last line is that there are no shortcuts to success, only hard work day per day.