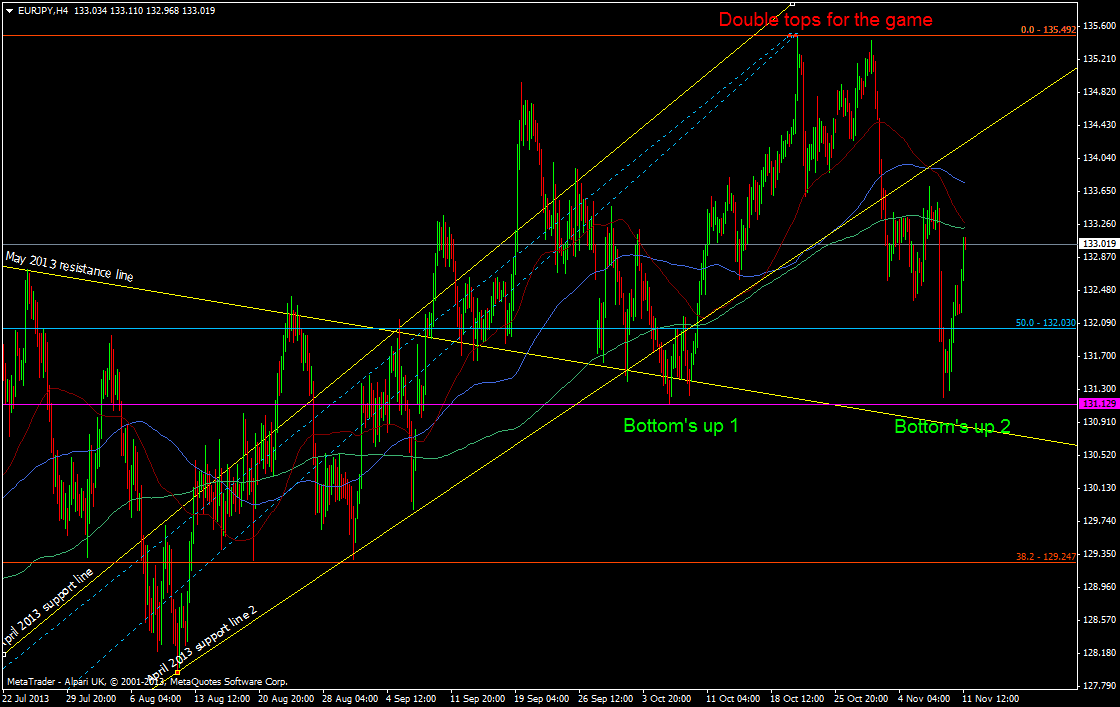

We’re pretty much bang in the middle of both on a short term basis with a second potential bottom being put in place last week down at the 131’s.

EUR/JPY h4 chart 11 11 2013

As with all yen crosses you can have a 2 on 1 effect playing out when either the dollar moves or the euro moves. At the moment both look like they want to go up rather than down and so it makes perfect sense to go with the flow. Either ends of the levels may provide an opportunity for to trade against but I’d be wary of another quick move down to the 131 area. The two ends are also enclosed in strong monthly support and resistance at 129.06 and 135.71 respectively so a break of the double top and bottom would bring these into play. What is a fairly good sign for longs is that we are above the 100 dma and have reclaimed the 55 dma.

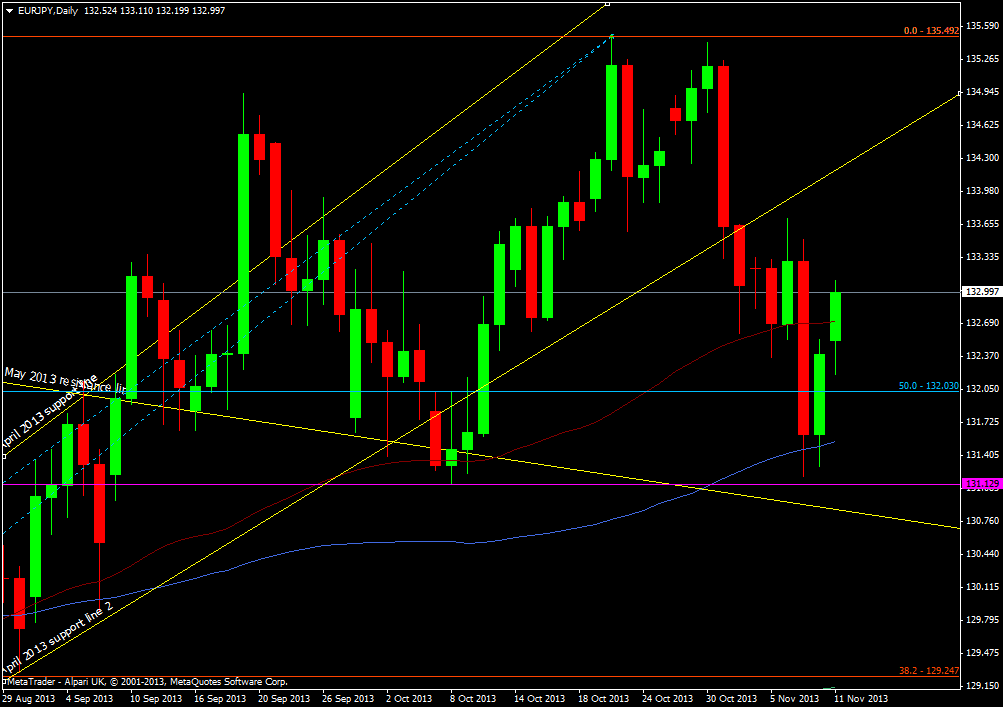

EUR/JPY daily chart 11 11 2013

A close below the 100 would be the first real sign of trouble for the pair.

Just like the major, USD/JPY, we’ve come a long way and are looking to range for a while. Any big dips down towards 128, 125 or 120 are good levels to look at longs if you think that the EU and Japanese recoveries are possible.