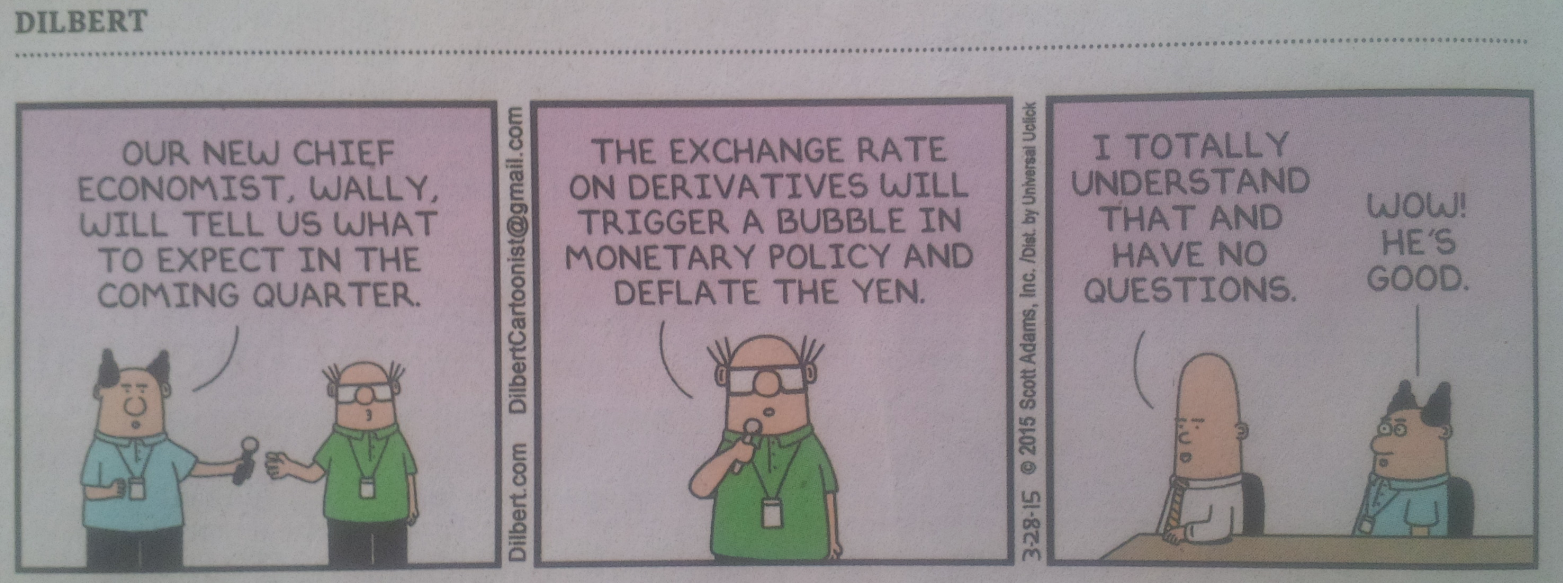

If you can't understand someone, that might not be so bad

When I started out in finance I had the good fortune to be able to interview many of the notable names on Wall Street and many more of the people surrounding them.

Without exception, they all ‘sounded’ smart. But over time I began to notice a difference. Some of them were really smart while others only sounded that way.

At some point I realized that many of the analysts were more concerned with sounding right than being right. As I paid closer attention I began to realize the people who sounded the best were the ones who were most often wrong, and not just wrong with predictions but wrong with the news, the facts or the state of markets.

I began to see that the people who were most often right were the ones who kept it simple. Instead of trying to justify the latest 40-cent move in oil prices because of a declaration of force majure in the Congo, they would say that kind of swing was the ebb and flow of the market or simply “I don’t know.”

Listen to the people who can boil down ideas to their simplest descriptions. Ultimately markets are a simple equation — either ‘buy’ or ‘sell’. With a trade on gold you can tally up a dozen buy or sell signals and bet on the outcome of a mining strike in Pretoria or you can recognize that the vast majority of gold flows are unknowable.

Even with technicals, you can draw 20 lines on a chart or you can take a wedged gold chart and say “go with a break in either direction”.

The trade on gold was simple

When I draw a chart like that I’m aware of the momentum indicators, the overbought/sold indicators and the various other technical signals let alone the volumes of news that could sway gold. It’s just that none of it was particularly critical, at least in the eyes of the market.

More trades have been ruined by making them too complex rather than too simple. Hardly a day goes by where I don’t read 1,000 words from a currency analyst on the euro that wraps up with something like “we feel this outlook can be best reflected by buying a Dec 1.3820 put funded by selling Oct 1.3645 calls with the dual caveat that Draghi hints at ending sterlization on June 5 and the euro trades at a 1.35-handle before May 31.”

Part of the complexity is an effort to sell clients complicated trades with even more complicated fees but far more of it is to feed the astonishing egos of the analysts.

The euro touched a three-month low today but every day since the May 8 ECB meeting an analyst has said negative deposit rates and other ECB measures were now fully priced in. The simple trade was to sell when Draghi said the ECB was comfortable cutting rates and to hang on for dear life, or at least until he’s forced to put his Refi Rate where his mouth is.

Here’s a good article about keeping things simple.

Always remember that the word sophisticated has roots in “Sophism.” At one time, these ancient Sophist philosophers had a very bad reputation for being more concerned with winning arguments than arriving at truth.

Swap out the words ‘Sophist’ with ‘analyst’ and ‘arriving at truth’ with ‘arriving at profits’ and you get the idea.

Here an example of Goldman Sachs ruining a great idea by making it too complicated.