If market moves don’t make sense, look to the calendar.

It’s a ho-hum day in the FX and bond market while stocks take an absolute beating. The S&P 500 is at the lows of the day, down 30 points to 1940.

Sure the Chicago PMI was weaker and there were some hiccups in earnings reports but nothing to indicate trouble in the economy. The GDP/Fed combination was about as good as it gets for stocks with growth accelerating and the Fed keeping its foot on the accelerator. If today’s stock trade was about a slightly more hawkish tone from Yellen then bonds and the US dollar would be higher.

It’s very rare for the stock market to be leading bond and FX so I don’t trust what equities are saying today. It’s likely a case of fund managers selling stocks on month-end window dressing.

What’s especially telling is the correlation between stock market moves today and month-to-date performance.

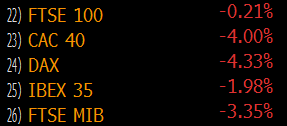

European stocks month-to-date

UK stocks (FTSE 100) are down just 0.6% today compared to 1.5-3% in the Eurozone.

I believe you’re seeing a fund-driven, calendar-driven move in stocks salted with some real (and less real) worries. Overall, the worries could last another day or two but I don’t see a reason for fear (and neither does the FX market).