US January inflation data is due at 1330 GMT Wednesday 14 February 2018 . earlier previews are here:

As an aside ... if CPI ain't enough for you its VIX option expiration day. Have a good one! ;-)

As the headline to this post says, in expanded form (via Société Générale):

- The recent selloff in markets has been attributed in part to concern over an outbreak of inflation, so this week's CPI report will be closely watched

More from the bank:

We look for a 0.4% monthly rise in the headline CPI and a 0.2% core reading. Despite the firm monthly prints, the annual inflation rates likely moderated. Given the focus on inflation, markets will also watch the PPI and the import price index releases, especially given expectations that a weaker dollar will result in higher imported inflation. Meanwhile, after a robust Q4, retail sales for January will likely show some moderation in the pace of spending

headline CPI 0.4% (0.369%) in January

- which would push the yoy rate down from 2.1% to 2.0% (1.964%)

- with a risk that it could round down to 1.9%.

core rate could have advanced by 0.2% (0.170%)

- but the annual rate likely decelerated from 1.8% to 1.7%

The NSA index may have printed 247.608

Our forecasts were recently updated for some tweaks to a few components, as well as the incorporation of newly published seasonal factors.

Westpac:

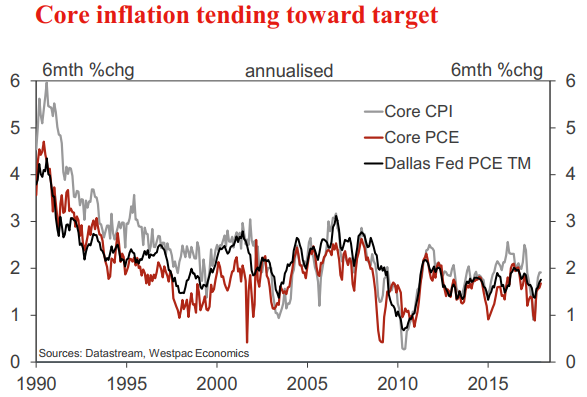

Core inflation (excludes food and energy) printed its strongest increase in 11 months in December as prices rose 0.3%.

- Price gains were broad based across the sub sectors, with the most significant contributions coming from autos; health and rents.

- Overall, the December outcome gave further support to the view that the inflation pulse is strengthening.

- Over the year to December, core prices were up 1.7%yr, headline inflation 2.1%yr.

Come January, a similar result is expected, albeit with momentum in core inflation being a little more modest.

- Core prices are expected by Westpac and the market to rise 0.2%, leaving annual inflation at 1.7%yr.

- Headline prices are likely to rise 0.4% in the month thanks to strength in energy inflation.

- Base effects should still see annual headline inflation tick down to 2.0%yr, from 2.1%yr in December.

Capital Eco:

Vehicle prices driving up core inflation

Our calculations point to a 0.4% m/m jump in consumer prices in January, due to the increase in gasoline prices

- and another 0.3% rise in the core rate.

- The weekly gasoline price data show that pump prices averaged $2.67 in January, up from $2.60 in December. After seasonal adjustment, that points to a 5% increase in the CPI gasoline component last month. Natural gas prices also rose quite sharply in January, reflecting the unseasonably cold weather at the beginning of the month, providing a further boost to energy inflation.

- Meanwhile, the producer price data suggest that food price inflation has continued to trend gradually higher.

Elsewhere, we have pencilled in a 0.3% m/m gain in core prices, matching the increase seen in December.

- Vehicle prices are still being pushed higher by the post-hurricane surge in vehicle demand. Falling clothing prices have been the main drag on inflation recently. But the pick-up in producer price inflation and cotton prices points to a rebound in clothing inflation this month

---

Long live cryptocurrencies? Five insights from the ASAC Fund