Purchasing a 'physical' Bitcoin token on one of the many exchanges may be a challenging task for beginners. A fear of fund security, lack of regulation, and high volatility cause many investors to avoid buying cryptocurrencies.

SimpleFX however has simplified this process with a new cryptocurrency offering in a safe and secure manner. These instruments have proven to be wildly popular with clients, having gained traction as one of the group's core offerings recently.

Hodling vs Trading -What's the Difference?

Of note, many brokers have been on the fence about cryptocurrencies recently given the tendency for clients to hodl. Unlike its competitors however, SimpleFX however does not see this as an issue, but rather a chance to better serve its diverse client base.

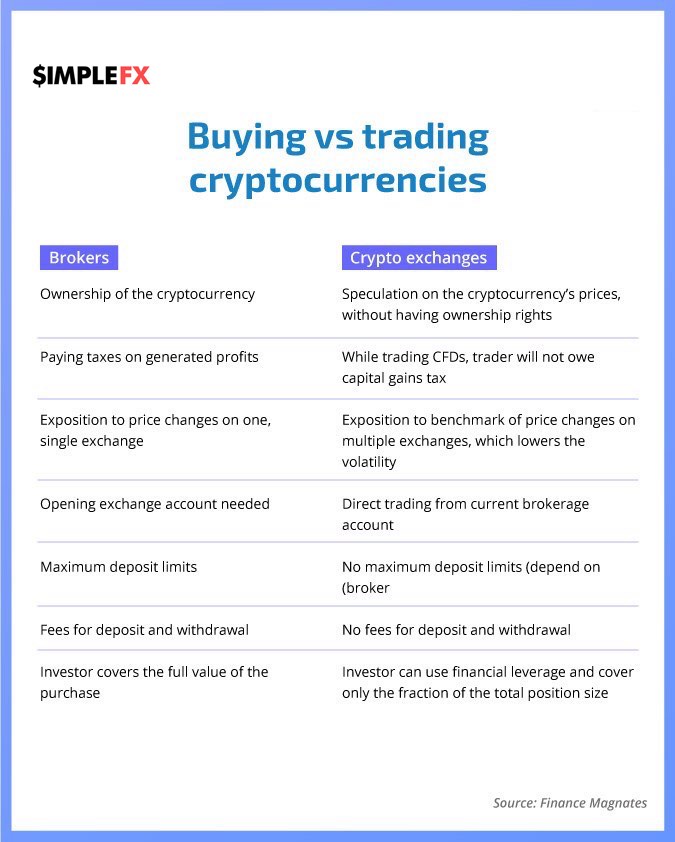

As stated in the table above, the main difference between buying and trading cryptocurrencies is the right of ownership. However, in order to obtain a unit or fraction of a given digital asset, investors are obliged to set up an exchange account and store the purchased instrument in a private wallet. The vast majority of crypto exchanges still lack regulation, which increases the risk of the loss of your funds.

Newer and inexperienced clients might find it especially hard to finalize the buying process. When purchasing physical bitcoins (or other cryptocurrencies), opening an account may even take few days, as the recent cryptocurrency boom has caused delays

What is more, for new users the maximum initial deposit is usually restricted to relatively low values. Add on the fees for transactions and withdrawals, and you may be in a situation where physical purchase is burdened with too many negatives. The main advantage, however, is ownership of a token, which could allow for profit in the long term.

For example, if you had invested $1000 in Bitcoin one year ago, your initial capital would have multiplied by nearly a factor of twenty at its peak. The value of BTC began 2017 at below one thousand USD, but it skyrocketed to almost twenty thousand USD twelve months later.

SimpleFX supports a wide range of Bitcoin trading as well as Bitcoin payments, which it started offering as soon it launched its trading platform. The group has also recently expanded its offering to accept deposit with other cryptocurrencies such as Litecoin, Ethereum, Dash, and Bitcoin Cash.

Of note, traders do not always care about physical possession of an asset. When trading commodities, does a trader count on an actual supply of wheat, copper or orange juice? No. And in terms of cryptocurrency, the derivative instrument might be a much better and more convenient solution.

Crypto CFDs - Earning Through Price Fluctuations

Cryptocurrency derivatives like CFDs give an opportunity to speculate on whether a chosen market will rise or fall in value. In this case, Bitcoin trading works in the same way as opening and closing positions on the forex market. Prices are quoted in traditional currencies, and traders can use financial leverage to boost profits even with a smaller initial deposit, gaining larger exposure to the crypto market.

If someone does not want to go through the tedious process of setting up an exchange account, CFD trading may sound like a quicker solution. In this case, the trader does not access the cryptocurrency exchange directly - that is the brokerage's role.

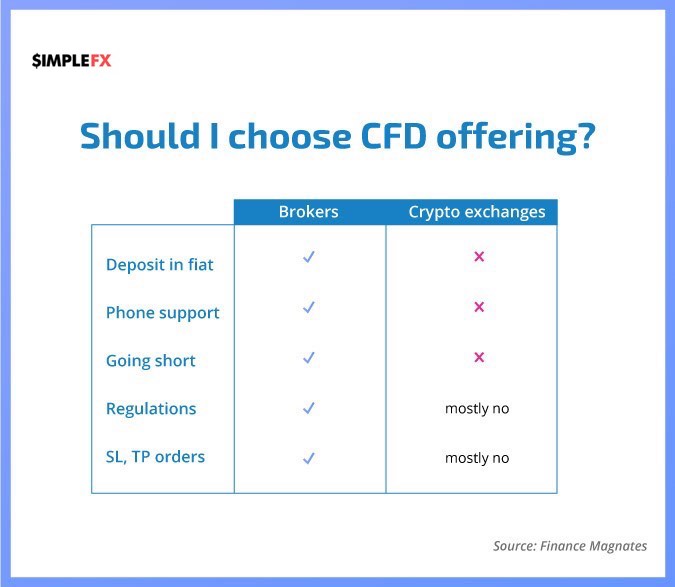

Retail brokerages are forced to comply with tight financial regulations, and thus they guarantee a greater level of security, better customer service and higher transparency. SimpleFX has positioned itself to maintain a diverse offering, whilst being fully regulated and transparent for clients' maximum piece of mind.

It

should be also noted that CFD brokers have much more market experience than

cryptocurrency exchanges, which have only been created relatively recently.

Investment companies offer more developed analytical and trading platforms,

allowing traders to open pending orders, use methods such as 'take profit' and 'stop

loss', and use automatic strategies.

Summary - to Hodl or to Trade, that is the Question

Purchasing cryptocurrency and speculation on derivatives both have strengths and weaknesses. If the investor wants to possess physical bitcoins, use them in everyday payments and multiply capital in the very long run, then the hodl strategy would be the best.

However, wanting to quickly, safely and effectively join the dynamically developing market, it seems better to bet on CFD brokers. Maybe Bitcoin will not appear in your wallet, but you will gain fund security, better support, and investment opportunities even during the downward momentum of a bear market.

In terms of wallets, SimpleFX' clients value crypto payments for the speed of transferring funds, while also checking confirmations on the blockchain network to verify if the payment was already processed. The group emphasizes security measures, as 95 percent of SimpleFX's crypto funds are stored in an offline cold wallet.

By extension, SimpleFX has kept the remaining 5 percent in a hot wallet to make sure payments are processed within a few hours after submitting withdrawal requests. Currently, SimpleFX's clients have a strong interest in not only Bitcoin but a wide range of altcoins as well.