What will ultimately drive this market is economic data and with banking issues slowly moving to the backburner, that means that the numbers will be back in the spotlight. There remains high uncertainty about the strength of the economy and the path of inflation so every data point matters.

Today's economic calendar starts off with a pair of non-market-movers in Feb advanced goods trade balance and wholesale inventories. Those are big factors in GDP though and with the Atlanta Fed tracker running at 3.2%, another upside surprise could get the market worried.

At 9 am ET, the focus is on housing with the price indexes from Case-Shiller and the FHFA. Pricing data is a lagging indicator and this is January data but the market is full of housing bears and steady prices in a high-rate environment could erode some of that confidence in short order.

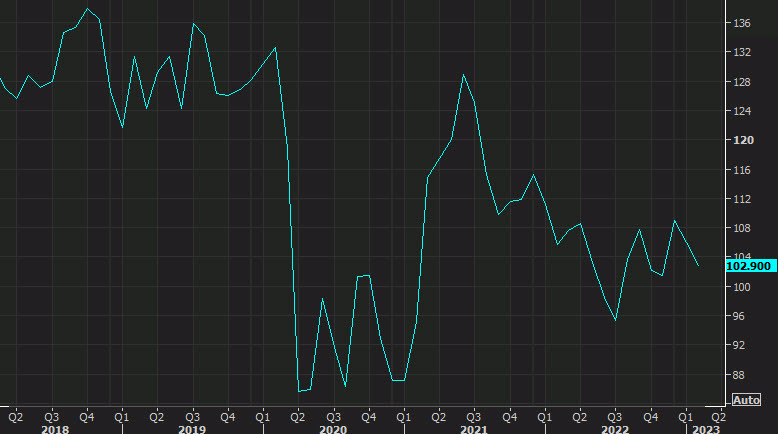

The main event comes at 10 am ET with the release of March consumer confidence and the latest Richmond Fed. Both are potential market movers and are good forward-looking indicators but the one I'll be watching most-closely is on the health of the consumer. The Conference Board's measure is much better than the comparable survey from the University of Michigan and is expected to dip to 101.0 from 102.9.

The survey measures the level of optimism or pessimism among consumers regarding their present and future financial situations. A high level of consumer confidence typically signifies that consumers are more willing to spend, driving economic growth, while low consumer confidence can indicate potential economic slowdowns.

On the speaker schedule, there is Lagarde at 9:15 am ET (1415 GMT) and the second day of testimony from the Fed's Barr at 10 am ET.

For more, have a look at the economic calendar.