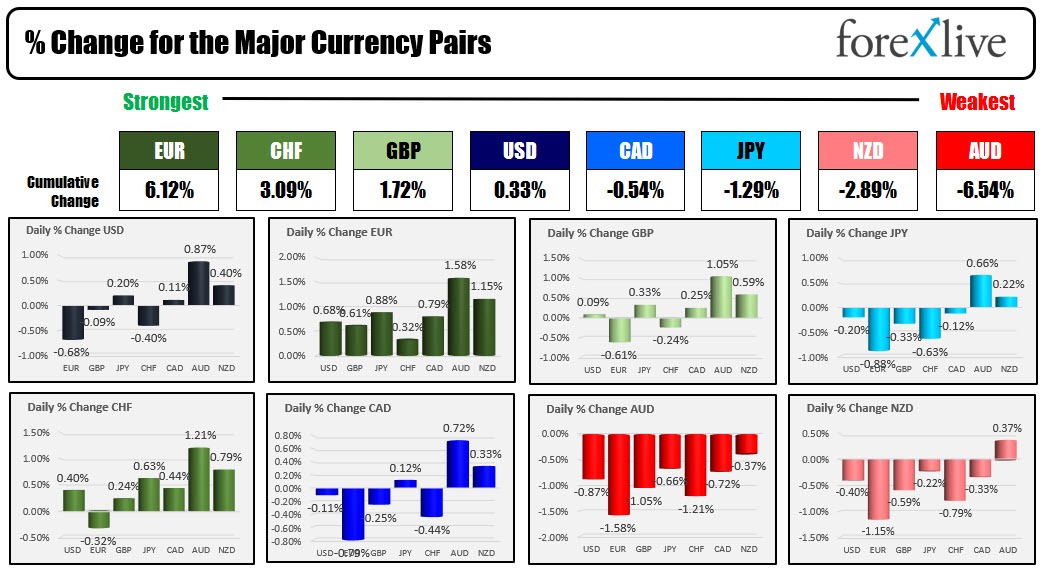

The EUR is the strongest and the AUD is the weakest as the NA session begins. The USD is mixed with gains vs the AUD, NZD , JPY and CAD and declines vs the EUR, CHF and GBP. The stocks have gotten off to a good start in October so far with solid gains for the 2nd consecutive day in pre-market trading after gains of >2.25% yesterday. Yields are lower.

The RBA pivoted with a rise of 25 basis points to 2.85% from 2.60%.The RBNZ is up next with their decision tomorrow with expectations also pointing to a 50 bp hike. Will they pivot next?

Below are some of the comments from the RBA statement. The AUDUSD fell initially, then snapped back higher before moving back lower. The pair is trading back below the 200 and 100 hour MAs (at 0.6497 and 0.6473 respectively.

- Rate rise will help achieve more sustainable balance of demand and supply

- Board is committed to returning inflation to the 2–3 per cent range over time.

- Cash rate has been increased substantially in a short period of time.

- Size and timing of future rate rises will be determined by the data and outlook for inflation and the labour market

- Medium-term inflation expectations remain well anchored, and it is important that this remains the case

- Board expects to increase interest rates further over the period ahead

- Given the tight labour market and the upstream price pressures, the board will continue to pay close attention to both the evolution of labour costs and the price-setting behaviour of firms in the period ahead.

- Board remains resolute in its determination to return inflation to target

The US has factory orders (including revisions to the durable goods data) and JOLTs job openings will be released today. This is employment week. The JOLTs data has remains elevated. The NFP is expected to ease to 265K on Friday from 315K last month. Fed speak today includes Fed's Bostic, Barkin, George, Jefferson, Mester.

Looking at the other market, the morning snapshot is showing:

- Spot gold is trading up $4.60 or 0.27% at $1703.82

- Spot silver is trading up up $0.047 or 0.24% at $20.72

- WTI crude oil is trading up $1.17 at $84.78 up 1.2%

- Bitcoin is trading at $19,949

In the premarket for US stocks, the major indices are trading solidly higher for the second consecutive day. Yesterday the major indices all closing higher by over 2.25% is the relief rally in October gets a nice kickoff

- Dow industrial average is up 395.11 points after yesterday's 765.38 point rise

- S&P index is up up 59 points after yesterday's 92.83 point rise

- Nasdaq index is up 229 points after yesterday's 239.82 point rise

In the European equity markets the major indices are also rallying smartly

- German DAX is up 2.95%

- France's CAC is up 3.57%

- UK's FTSE 100 is up 2.02%

- Spain's Ibex is up 2.68%

- Italy's FTSE MIB is up 2.7%

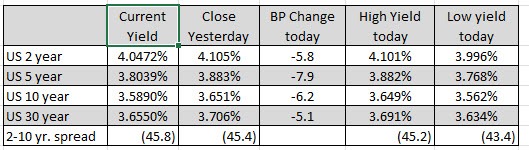

In the US debt market, the yields are trading lower as investors continue their run into the yields and a more balanced portfolio, and thoughts of pivot from central banks starts to permeate into the markets. The 10 year yield in the US traded as high as 4.019%. It is currently below 3.6%.

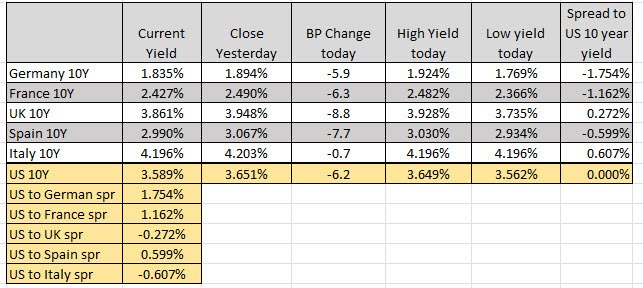

In the European debt market, the benchmark 10 year yields are also trending to the downside. Last week the German 10 year yield reached a cycle high of 2.352%. It is currently trading at 1.836%. EU inflation peaked at 10.0% last week (core 4.8%).