Risk management 101

This article is for you if you want a starter on risk management that is practical and simple to follow. I have written recently on the attitude required to manage money. See this article here on talking about the M-word. I have also written previously on the use of leverage and how using too much leverage is the bane of many traders accounts: 5 trading mistakes to avoid: Mistake#1 over leveraging. This article combines those two principles into a practical guide to follow. In order to get the most of this article it will help if you have read the first two. This article is primarily aimed at those starting FX trading or those who have never laid out a risk management plan. I will make three points in this article all of which are designed to help you preserve your capital:

- Decide to trade with little leverage

- Decide when you will stop trading: The 10% rule

- Decide how to use your FX funds for the maximum benefit.

Some starting assumptions

Before we get into the point above, I want to outline two assumptions I have made.

Assumption #1

I am assuming that you want to manage your account in a way that allows you to grow that account so that you are trading a significant sum for yourself.

Assumption #2

I am assuming that you are wanting to responsibly manage your risk, so that you can make changes to your trading once certain parameters have been hit

With those two assumptions aside, let us look at a hypothetical example of a trader who has 10,000 units of currency in their account.

1. Decide to trade with little leverage

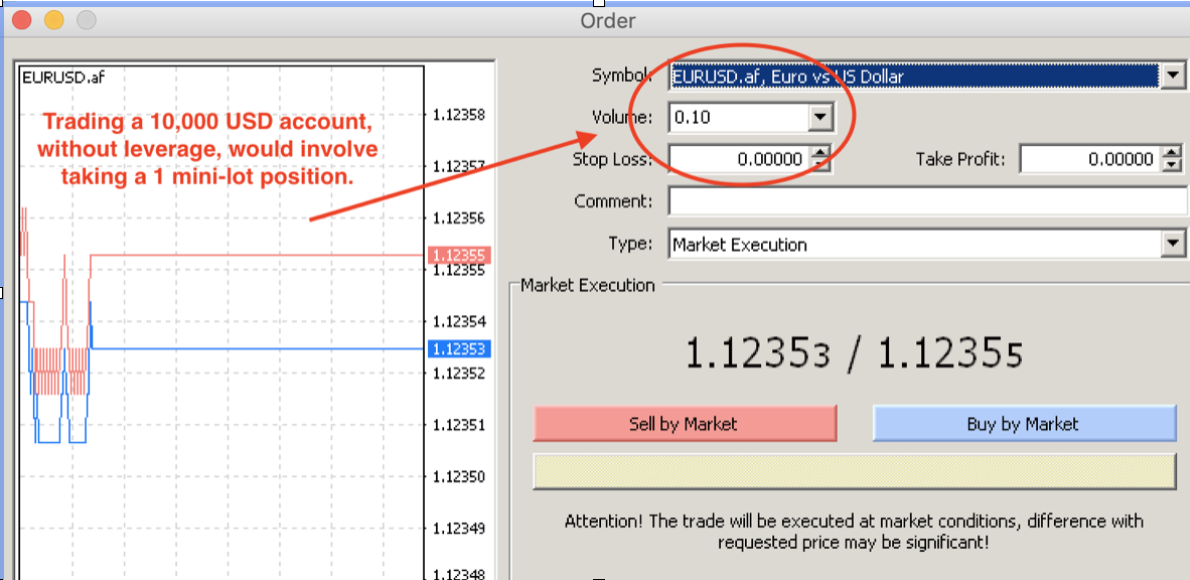

Leverage is simply the ability to trade a position sizes larger than your account size. Think of your account size vs your account size.If you have a 10,000 size account then trading without leverage will involve trading a lot size that is equivalent to your account size. So, if your account size is 10000 then trading without leverage will involve trading a mini lot of 0.10 See screenshot below for an example of a non-leveraged trade on a 10,000 account.

The less leverage you use, the easier it is on your trading psychology. So, do yourself a massive favour and de-leverage. I personally trade without leverage and only leverage up on the highest conviction trades, e.g interest rate surprises on major central banks. Furthermore, I rarely have more than two positions open at the same time on different pairs.

2. Decide when to stop trading: The 10% rule

Take this rule from me, it will save you money. So, let's say you take this lesson on board that you are trading without leverage on your account and your account keeps going down. When do you stop trading and realise that you are not quite ready to trade? Don't wait until you have lost 50%+ of your account. You can know that something is wrong when you have lost 10% of your account. This is the point where you say, 'Ok, I am trading without leverage and I have lost 10%, so I need to reassess what I am doing'. Take an FX trading course, pay someone to mentor you, just stop doing what you are doing as you need more practise.

3. Decide how to use your FX funds for the maximum benefit.

This is when you can make leverage work for you. Say you have put aside 10,000 units of currency for trading and you are trading without leverage. In this instance there is no need to put all of your trading balance in with your broker. Instead, why don't you put aside some of the money into another investment. A good example in the UK would be to invest in premium bonds. You could put 8,000 units in premium bonds with no risk of devaluation (aside from inflation) of your investment and a chance of outperforming, but you can access your funds quickly if you needed to pull them across into your trading account. It is a good balance between offering a chance of growth vs safety and accessibility. I have bought premium bonds as a place to put my annual tax contributions before I have to hand them over to HMRC and had two winning bonds since April this year. Including one while I was on holiday, nice bonus on money that would otherwise be doing nothing.

.jpg)

Answering some common objections.

Objection #1 : But I won't make much money trading without leverage?

This may be true in the short term, but medium to longer term you will make money. If you can generate double digit returns over the course of a year you will be right up there with the best of them. Also, if you can prove to yourself that you can manage money responsibly you will have much more confidence adding extra capital into your trading account. You don't want huge equity swings in large accounts as they are not acceptable or practical for your trading psychology.

Objection #2 : But I don't want to stop trading if I lose 10% of my account?

Trading can be addictive, so don't get hooked. Why not take 3 months out of your trading to stick to demo trading. Then, after 3 months of profitable demo trading, get back onto your live account

Objection #3 : But I like the thrill of the market by using high leverage

The 90/90/90 rule is that 90% of new traders lose 90% of their account in 90 days. Even experienced traders can succumb to the pull of the markets. You are never above needing to manage risk. The moment you think you are above the 'rest of them' is often the final thought before a fall. The number one cause of trading disasters is using too much leverage. If you want to keep enjoying the thrill of the market in an irresponsible way you need to budget for it in the way that you would budget for a holiday or household expense. In other words, it is money that you should already considered as spent. You are also establishingterrible habits that will prevent trading ever becoming a full time business for you as you will be unable to either attract investors or safely manage larger personal funds. Finally, the thrill can be addictive and may end up in you losing way too much money and that impact will overspill in other areas of your life impacting your relationships which you cherish and your own mental well being.