War story: The post-SNB trade that got away

I miss a lot of trades. For me, it’s part of the business and I’m perfectly fine with missing 50 trades for every one I catch. But this one was so big and so glorious and so perfect and soooooooo close that it’s still waking me up in the night almost two weeks later.

The only reason I’m writing it down is because I’m trying to let it go. It’s like a ‘bad beat’ in poker that sends you on tilt. Revenge trading is recklessly trying to make back something you lost (or should have gained) and it often ends in tears and I don’t want to let it happen.

Anyway, this was the trade:

It was Black Wednesday. January 15, the day the SNB dropped the EUR/CHF floor. I hate to even write about that day because it was tragic for so many traders and the industry. Everyone has my complete sympathy and I apologize for writing about a trade I missed on that day.

But that was the crux of the trade; it was a tragic day for the industry. There were a million things to take in and try to understand that day but I recognized early on that it was going to be a terrible day for retail foreign exchange. How do you bet on a bad day for the forex industry?

The first thing that came to my mind was to bet against the stocks of the publicly listed forex brokers – FXCM and Gain Capital. I intended to do just that via some put options.

I talked it over with Ryan.

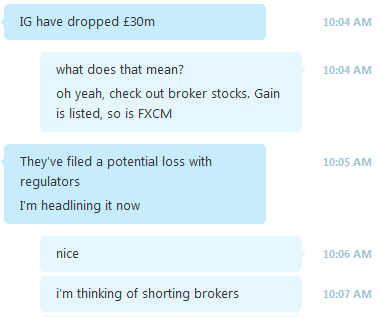

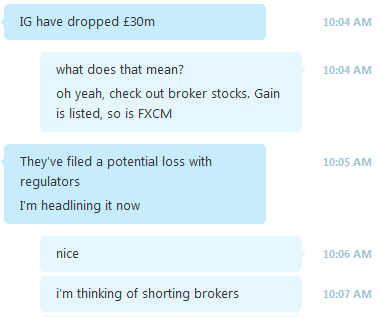

Snippet of a conversation with Ryan Littlestone on Jan 15

I called Ryan and we talked it over. Then I spent a couple minutes trying to completely understand who was an ECN broker and who was a market maker. It meant the difference between trading against clients that were wiped out and being stuck with negative balances and no hedge.

Looking back in my trading records, I put in an order for puts in Gain Capital and FXCM at 10:10 am. I bid on the $9 GCAP puts at 0.75 and the FXCM $12.50 puts at 0.20. They were at the money but didn’t get filled right away. Minutes later, I got cold feet and pulled the orders. I can’t remember everything but I think I was back into the market-maker/ECN debate in my mind and wondering if brokers could have, in fact, made a killing.

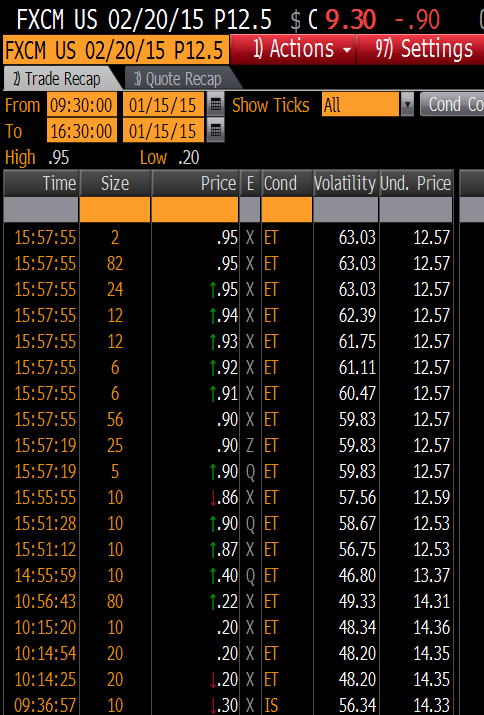

FXCM 12.50 puts on Jan 15 2015 trade recap

Those FXCM puts traded at 20-cents one minute after I pulled my bid.

After the close FXCM announced at $225 million loss and shares were halted. They reopened on Jan 20 and traded at $10.90. That’s a 54x return overnight. $9,000 would have been $500K in the morning. Even the gain Gain Capital puts nearly tripled within 24 hours before the dust settled.

My biggest regret is not stopping to think about it a bit longer. That’s the lesson I’m trying to take away because other ways of thinking about it drive me nuts. If I would have slowed down and gone over the pros and cons, I think I would have realized there wasn’t much downside in the puts. It was clear the regulatory problems, lost accounts and everything else would have outweighed any one-day gains for brokers. Shares of GCAP are still lower despite the company making money that day.

Anyway, I just wanted to vent about one that got away so I could clear my head and move on to the next one without doing anything stupid. There's no sense in dwelling on the ones that got away.