There is so much to learn from trading the Brexit vote

The market made so many mistakes today.

The crowd was paralyzed and foolishly following the vote tally when it should have been following districts to see how they were doing compared to expectations.

The trade wasn't about predicting the future, I thought Remain would win 8 hours ago. First of all, every trade is about controlling risk. There was no money to be made in GBP longs 8 hours ago. It was way too crowded. The first step is always controlling risk.

The big money trade was about analysing and interpreting the news faster than others. It was about finding a source like Chris Hanretty who had modeled virtually every district and interpreting how the numbers fit in.

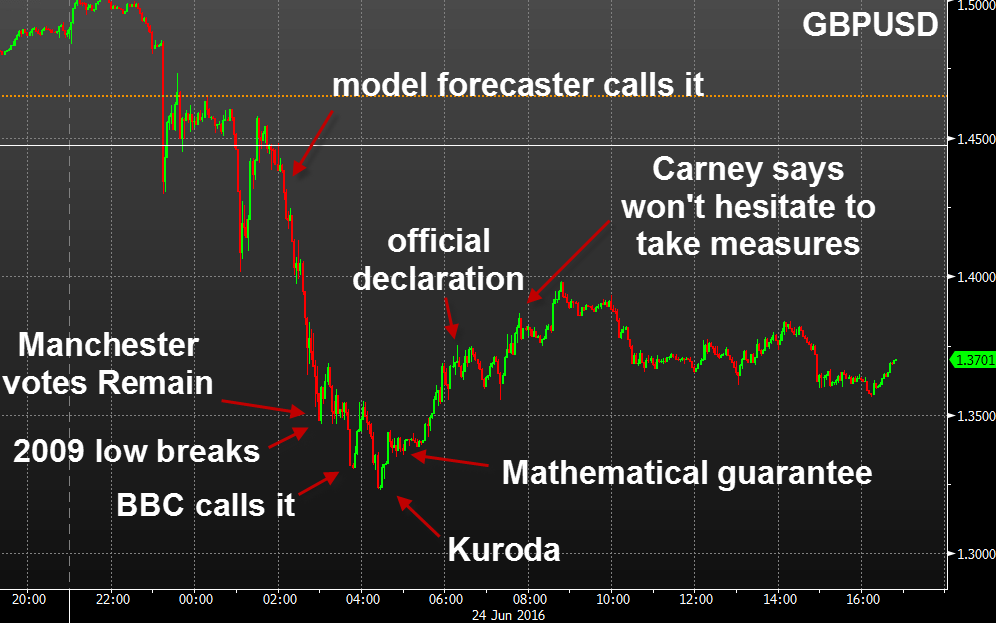

The whole world seemed paralyzed at various moments of the trade. I stood in there and called what was coming out. The numbers themselves didn't matter, what mattered was how they compared to what was expected and how the market was behaving.

I believe there's no better analyst in the world at what I did today. I put it together in real time and I can show you how to get ready for the next trade (there is always another trade).

Overall this referendum is going to destroy real money accounts and banks but if you were reading ForexLive for the past 8 hours I don't really see how you could have done anything but absolutely crush it.

Here were some highlights from today's posts:

- The GBP market is frozen in fear right now but Leave is very close to the lead - GBP/USD at 1.4580

- Chance of a Leave win at 68% - GBPUSD at 1.4570, before the big spill

- London is Cameron's only hope now - GBP/USD at 1.44

- It's over and it's a Brexit - model forecaster - GBP/USD at 1.4230

- "It's over" again - GBP/USD at 1.40

- Better trades might be outside GBP now - Gold at $1280, S&P 500 futures down 20 points (100 now)

That's not wishy-washy advice. It's the real deal. And it's not a gamble, it was backed up by real news.

I'll be back at it here again tomorrow and every day.