Some tips for the summer chop.

Summer trading can chew you up and spit you out.

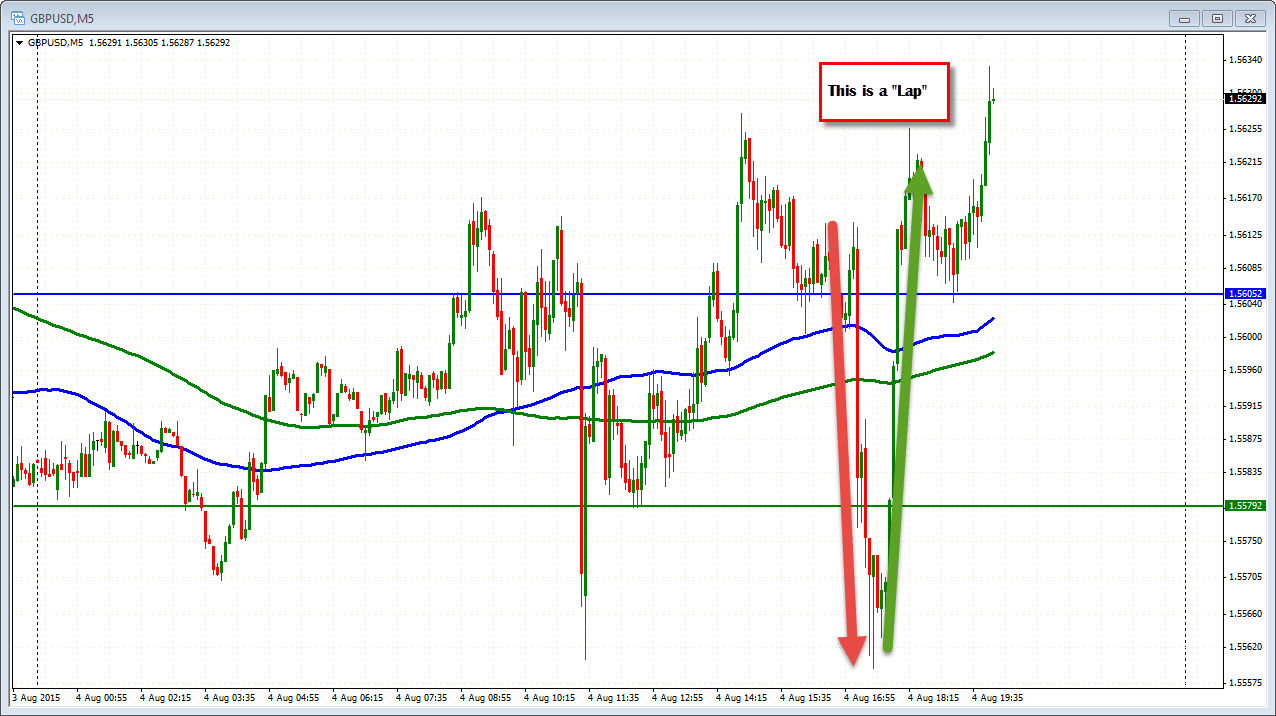

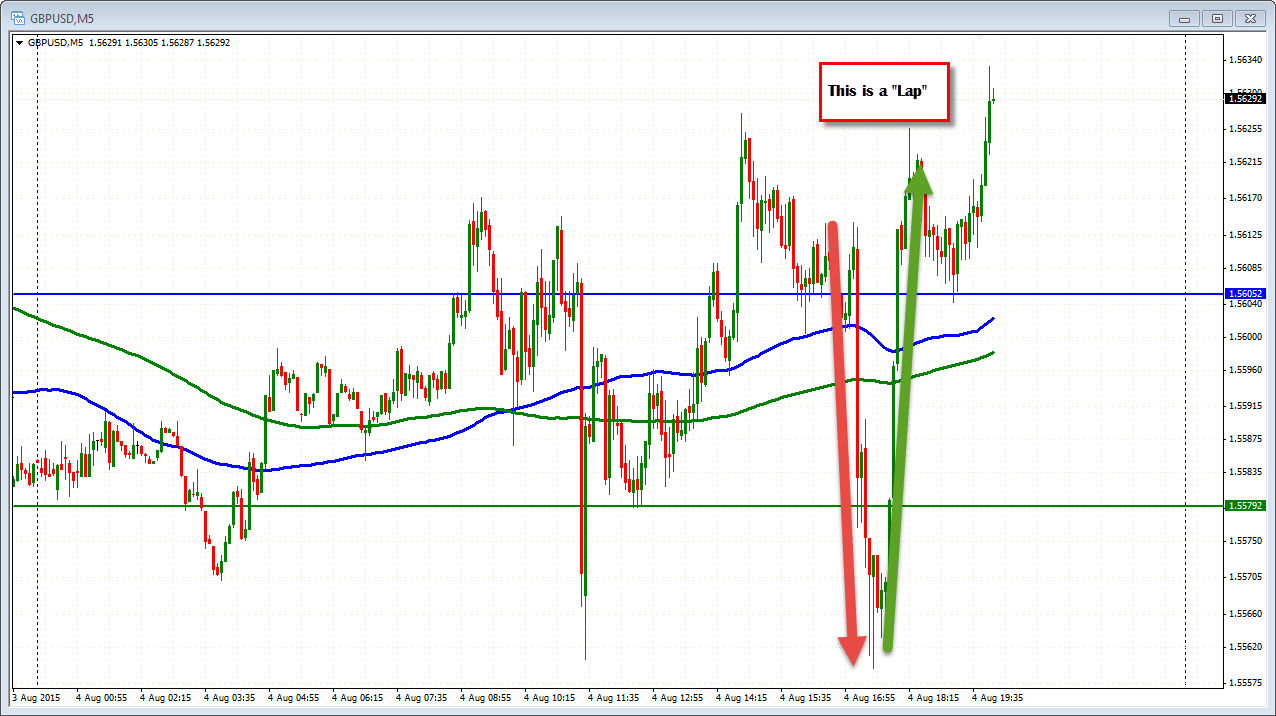

They typically are characterized by narrow trading ranges with potential for choppy two-way action. They also could lead to price action that seems like a trend move higher or lower, only to have that move completely reversed. I call it taking a lap.

Why does this happen?

Less liquidity in the market typically. If you have less "market moving traders" (i.e., the big boys), the swings can be exaggerated. Also, the traders that are around, may NOT have a strong bullish or bearish bias. That ends up stopping trends more quickly and can even lead to the sharp "lap" reversals that characterize these markets. Once again, a lap is when the price has a trend like move, only to reverse back in the other direction.

This is the lap we saw in the GBPUSD today. There were similar moves in the EURGBP and the GBPJPY. Was there a justification for the reversal? No. They just happen. There was no reason fundamentally. I may be able to say there was a technical reason but even technicals can become more unpredictable.

Such is life with liquid summer time markets.

So how can you protect yourself and your account?

1. Don't be surprised. I am telling you now that the above can happen, so be prepared.

One way to protect from the sharp reversal is to have a stop level in mind. I prefer to have the technicals tell me Yeah or Nay and those technicals to be close by...

For example, the GBPUSD fell below the 200 hour MA (green line in the chart above) and the 50% retracement. That is bearish and normally should lead to sellers taking charge. What if they don't take charge? The price can easily reverse and that is what it did.

SO when the price moved back above the 200 hour MA and the 50% retracement, that should be a warning. Do not be surprised if it goes racing back. In this case, the precedent was the the 3 other times if fell below and failed. If it can fail 3 times. It can fail a fourth. That is what it did. The price shot back higher.

2. On breaks look for targets to be passed. When you play a break, you are looking momentum in the direction of the break. So in the chart above, the 1.5560 level needed to be broken AFTER the 200 hour MA and 50% were broken to initiate the trade. When it could not be taken out, the traders who shorted, started to cover. The early ones booked a few pips and were happy. The ones who delayed, were chasing after the price moved back above the Break and fail level. How do you know it will not break below that target? You don't. But what you do know is the failure to reach the target could lead to the sharp reversal the other way. So pick out some close targets that you can see and assume "the market" can see them too. If they cannot be breached watch out.

3. Lower the trade size. It does not make sense to trade bid positions. Lower you trade size.

4. Trade the failures not the breaks. If the breaks fail, don't be the one trading them. Instead, look for the failures and trade the reversals (use smaller position sizes.

5. Map out extremes and buy low/sell high. Forget the middle. In the chart above, buy 1.5560 with a stop below 1.5550. On the top 1.5567 -81 is an extreme. If that is too narrow, look at a longer term chart (daily or 4 hour and widen out your trade extremes even more)

6. Consider a day at the beach. An option is to not trade but observe and learn when it is not a good time to trade. I like to say, it is easy to get in a bar fight. Just throw a beer in a face or do something to a girlfriend of a stranger.in a crowded bar. Easy. In trading, swings like we are seeing are bar room fights. You never know what may happen in a bar room fight. That is what we potentially face in the summer time markets.

The good news is they will end. You just have to wait em out....