Learn more about EAs, also known loosely as "forex robots" 5 Oct

EAs, also known loosely as "forex robots",are trading platform add-ons that have the ability to automate certain trading actions.

There are various types of off the shelf solutions, including STO's EAs included with Premium, Pro and VIP accounts which diverse functionality that can help you with opening and closing positions, analyzing data and even managing risk. Let's take a look at EAs and if they fit within your trading strategy.

Trade with free EAs and charts

Automated Trading

Essentially Automated Trading is a catch-all term when using automated processes for trading. EAs (especially those included with STO's top-tier accounts), give you a slew of automated processes to choose from depending on your investing goals and trading strategy.

Here is a disclaimer for those that think that EAs are some sort of mystical programming market kryptonite - EAs do not guarantee returns, there is no such thing as "easy money" - knowledge and constantly being informed of what is going on in the world that effect and move markets are the most valuable weapons in a trader's arsenal. Knowing how to manage risk and the tools to do so, being able to interpret fundamental and technical data, and knowing the various measures investors take to protect their assets is crucial.

Think of EAs as a hammer - a valuable and diverse tool, but building a house with just a hammer - although impressive - would inevitably be structurally unsound.

What are EAs?

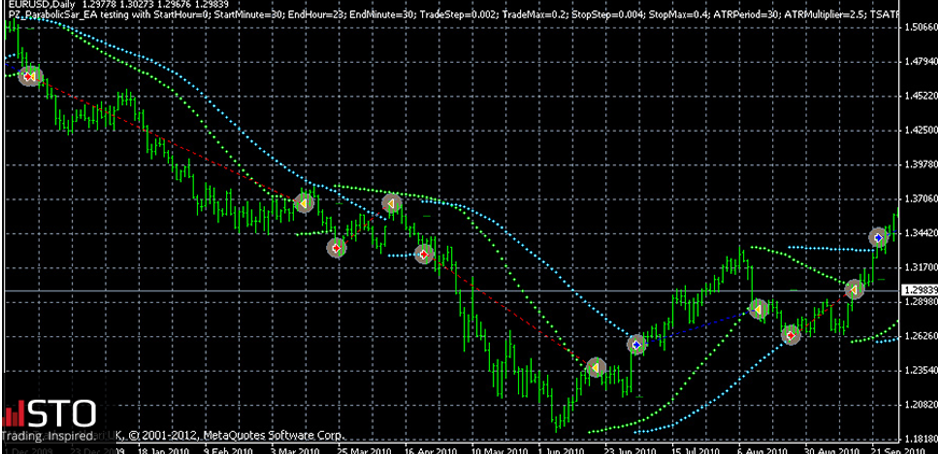

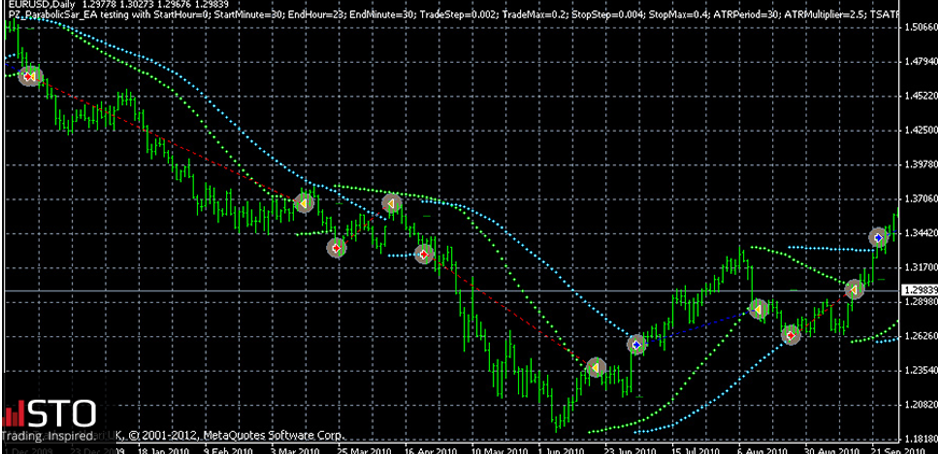

EAs are programs that are compatible with your trading terminal (usually MT4) that allow for certain actions to be automated, depending on the parameters defined when the programmer or trader sets them up.

Many EAs are cross-compatible, meaning you can use them in conjunction with each other, giving you multiple layers of automation, functionality and customization. EAs aren't just intended to be used exclusively for trading actions but can also send notifications for certain market movements, events or macroeconomic data. Although this second type of EA does allow a certain level of definition of variables, the parameters that trigger actions for them are more or less predefined.

What do EAs Do?

Once you acquire the basic knowledge of trading, you will be able to more effectively recognize when and where to use EAs, but technically all types and levels of traders can use EAs as multiple types of off-the-shelf options exist. These tools can help you enter and exit positions, look for signals to either indicate buy or sell and also streamline the process of opening or closing positions.

EA functionalities

EAs have various functions which you can harness for your trading strategy. The 12 EA's STO offers include, for example, the below:

Alarm Manager - sends you and your social media followers notifications, it also allows you to open positions or send notifications with one click.

Correlation Matrix - Displays and highlights relationships between instruments - showing you how tight or loose those correlations by color coding them.

Correlation Trader - This allows you to cross-reference two tradable instruments - allowing you to take advantage of the spread (or difference) between their two prices. It displays both the instruments' recent activity and your positions open on these instruments.

Excel RTD - This tool will allow you to easily populate data into an excel sheet, if you are familiar with VBA you can also use a program to open positions from within the excel sheet.

Market Manager - Fully control a user-defined watchlist. Displays open positions, account activity and order information depending on user-defined parameters - you can even update/change your positions from this EAs interface.

Mini Terminal - a trading terminal within a trading terminal. As the name indicates this does exactly what the MT4 but within MT4 allowing you to double the amount of information you receive within your terminal.

Sentiment Trader - you can compare your open positions to the current market sentiment through the display of number of long or short positions opened by other traders. This EA also gives you access to historic sentiment to compare to the price of your current positions.

Stealth Orders - This EA gives you the ability to keep pending orders imperceivably to other traders, this program also works for take-profit, stop-losses, buys and sells depending on the price that you have determined as exit or entry prices.

Tick Trader - This tool helps you read tick charts that can be changed between candlesticks, line, tick bars or timed - and you open positions within this EA.

Trade Terminal - This is a trade execution and analysis tool on par with the type of interfaces professional traders use. It allows you to create templates for orders that are used frequently, open position analysis, exiting and entering trades automatically.

Connect - You can create a custom news feed and economic calendar this also has the ability to be shared with other people.

As you can see EAs are a diverse set of tools offer everything from direct trading to market data analysis and features that can help you stay competitive in the market. As mentioned in the introduction, these can be combined, to automate certain functions while using a parallel EA to display valuable information, market news or the even the movement of the instruments you have open positions on.

Benefits of EAs

The most obvious benefit is automation - your stop-loss and take-profit levels can be set as parameters within a EA that will enter and exit trades depending on limits. For example the OTC market is open 24/5 following most of the world's major market - but are open around the clock - even if you are ambitious you wouldn't be able to trade around the clock - or at least you wouldn't be able to do so without making a serious mistake, exposing yourself up to serious risk (both financially and likely physically).

Another important benefit to using EAs is the lack of emotion. Notoriously known as traders psychology - the knee jerk reaction of exiting a position even though it isn't going through a reversal, not staying with a predefined strategy or even not opening new positions in a ditch effort to perform a haphazard version of risk mitigation.

This article is provided by STO Markets. The comprises the personal view and opinion of the STO Investment Research Desk and at no time should be construed as Investment Advice