There, I’ve said it. The taboo. This post from Adam rung a big bell with me and I want to try and dispel some of the myths that it’s dangerous to try and pick tops and bottoms.

The number one question we should ask before placing any trade is “why?”. “What is the reason, here at price level “x”, that will make me buy or sell?”

That question is valid at every single price level, whether it’s after a 500 pip drop in 10 minutes or a market ranging 10 pips for a week. Trading is always about having a reason to do something but that is often the last thing people think about.

Psychologically we see a big move and automatically want to fight it, “It’s gone too far”, “It’s oversold/overbought”, “The move makes no sense”. There’s always an instant, off the bat reason why we should trade against a move.

Reader Yet Another Ryan nailed it yesterday:

“No matter what time frame we trade in, we are always picking tops and bottoms. Some people call it “order levels,” some call it “support and resistance,” some look for heads and shoulders, some say they are “limiting risk”, whatever that means. A million ways to trade, pick your poison. All traders, no matter how passionately they deny it, live and die by picking tops and bottoms every single day, every single trade. We find signals that work and use them as indicators until they don’t work anymore and if we are going against trend, we better have or reasonable expectations of success and be willing to stop out.”

You should be willing to trade at any level, after any type of move, as long as you have a valid reason why. Be it a headline, an indicator, price action, as long as it’s more than just “I think xxx”

Here’s an example. Let’s take EUR/USD and GBP/USD after some big drops

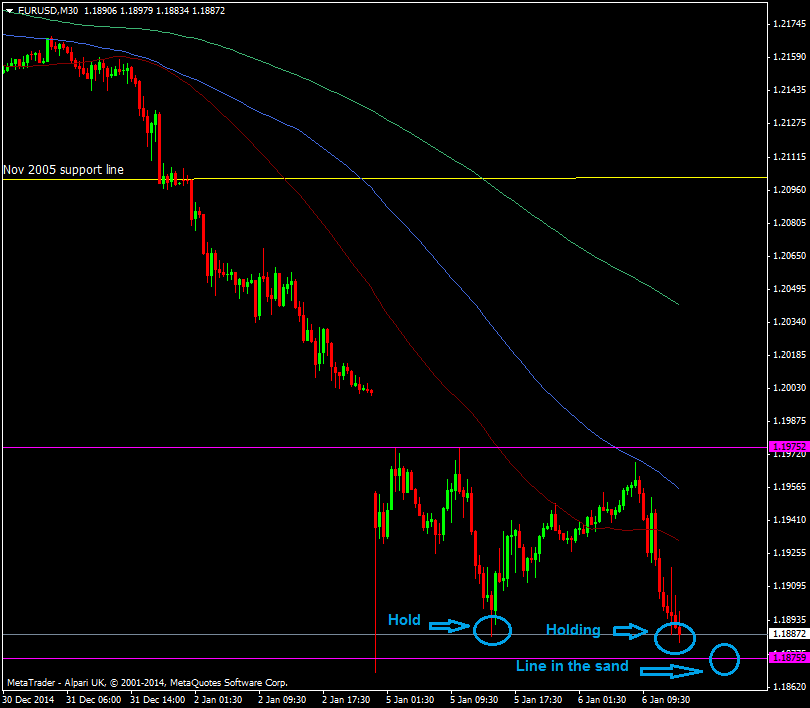

EUR/USD M30 chart 06 01 2015

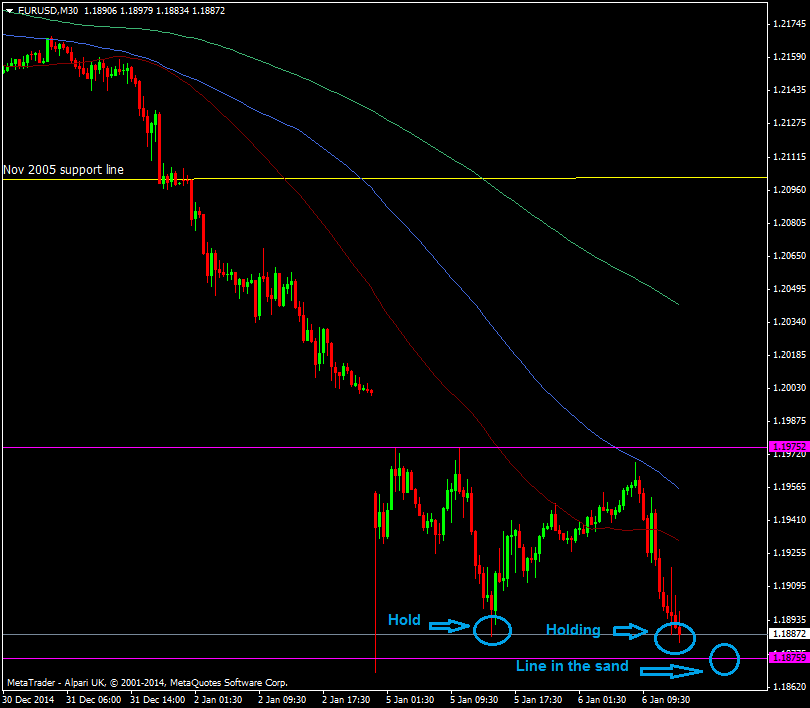

GBP/USD M30 chart 06 01 2015

Whatever we do it’s a 50/50 trade. It always is. What we want to look for is a reason. The reason to buy the euro is because it’s bounced from the initial fall then held a drop just above (around 1.1880/90 and is currently trying to hold another attempt here. The price action is saying that there are willing buyers at this level and that they’re making it tough for the price to go down. There is only one other direction it can go if the buyers successful.

The reason not to buy the pound, on what is a similar picture, is that the first drop after the initial 1.5168 low (around 1.5200) has been broken. It’s instantly become resistance and here we are breaking 1.5168 to 1.5160. If it had held 1.5200 today then you have a reason to try a long.

Of course, this is no magic formula to say the trades will be a success. What it does do is give you a reason by watching the price action. My view of trading is not learning how to win, it’s learning how not to lose. What factors are there that could cost me money? The break in cable of 1.52 could have lost me money on trying a long from that level. If it held then you’ve got a stronger conviction to buy it.

Once you have given yourself a valid reason to trade, and only you can really know honestly that it’s a good valid reason, then it shouldn’t matter where you push the button on a market. Add in reasonable expectations for that particular trade (no one should be looking for a 300 pip bounce from EUR/USD holding 1.1880/90), and trade management, and you put yourself in a position where you lower your chances of losing on a trade, not raise your chances of winning.