Trust is the key to trading

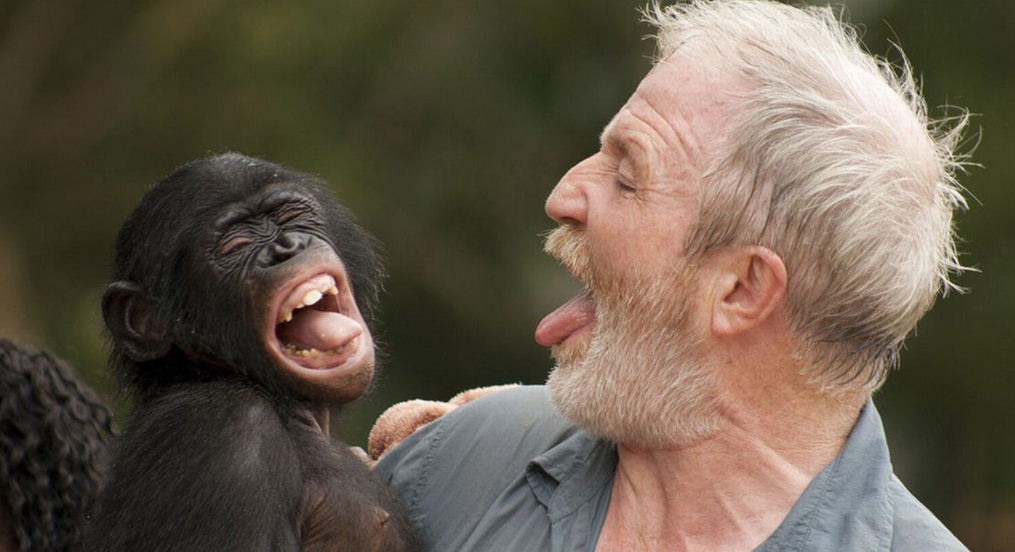

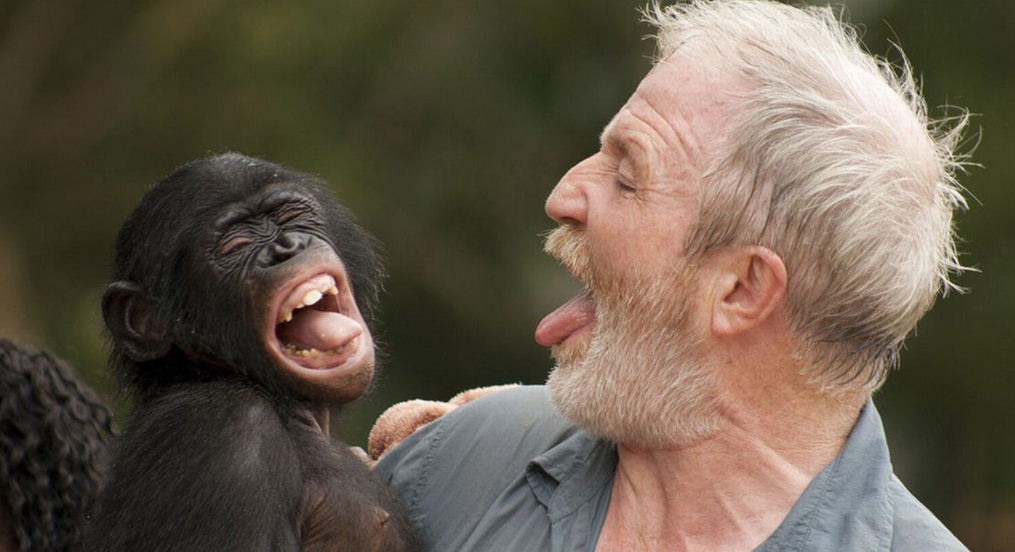

The living species of the planet all share one major trait and that’s caution. We all have the ability to assess risks and look for dangers. Caution is pretty much at the forefront of our thinking, when you walk down the street, drive a car, any number of everyday activities has an elemental need for some caution, minor or major.

That caution plays a big role in how we trade.

I’ve just been reading a very good article on Australia from Bryan MacDonald in RT.com. He highlights the risks, the probable impending bust of the economy and paints a picture that is gloomy at best. His reasoning is succinct and in no way over dramatised. I dare anyone to read it and not come away feeling bearish for the aussie dollar.

And that’s what brings me on to my point. The vast majority of us always look for the worst in any given situation particularly when dealing with trading.

- The US Fed say the economy is on the up -We say it’s whole different world on Main Street.

- The UK is doing well – We say it’s still saddled with massive debts and an impending housing crisis.

- Europe is exiting the crisis and seeing light at the end of the tunnel – We say dream on.

We don’t trust our governments, our central bankers or anyone involved in making decisions for us. It’s the nature of things.

What we do have to do if we want to make money from this game is switch some of those thoughts off.

We can all look out the window and find 1000 things wrong with the world we see compared to what we see on the trading screens. This is why you have to disassociate yourself from those views sometimes if you want to trade successfully. You have to put yourself in the market’s mind and try to read what it is feeling. Think Europe is failing and the euro should be trading sub 1.20? The price on my screen says different.

At times the market is a simple creature in itself. All it wants to know is if a country/economy is going to disappear into a fiery abyss or not. If it is, sell it. If it’s not, buy it.

In that equation human nature always errs towards the negative aspect.

When I’ve put up strategies like the AUD/USD and EUR/USD longs I’ve gotten around a 5/1 split on negative views vs positive views. The truthful fact of the matter is that both sides could be right and this is where we need two very important things.

- The ability to tune out caution (to a certain degree)

- Money management

Let’s look at the first aspect.

Everything in that article above could happen and Australia could plunge deep into the mire. Trading wise it doesn’t matter to me as I can only go on what is happening right now and what the market thinks as well. I don’t pin my colours to the mast and then walk away to come back in a few weeks/months to see how things are going, I watch and listen everyday to what is going on. If the plan is following my parameters then I’m good. If they change then I re-assess.

Secondly;

Money management, money management, money management.

We preach it as often as we can on ForexLive and that brings me on to my next point.

It is irrelevant if Australia/Europe/UK, whatever blows up as my trades are well managed. I have my break points and I have my assessment points. Either way what I stake I am prepared to lose and that takes the worry factor out. It does not matter whether I lose because my strat is wrong or because a talking head blows my position or any number of unknown events that could happen. I’m prepared for the loss any which way.

You can’t be rigid in this game but you have to have caution. They key is to try to minimise the effects of the caution shown by others. I was very nearly shaken out of my aussie longs in full because of the negativity I kept hearing. It got into me and made me question myself. I even cut back some of my position because of it. I’m now locked into a very healthy profit because of tuning out the negative vibes.

I won’t always be successful in my strategies but what I will always be is prepared, and that’s half the success in itself.