It’s well known that currencies are closely linked to interest rates movements. The reason of this relationship is pretty simple: higher interest rates tend to attract foreign investment, increasing the demand and value of the currency. On the other hand, lower interest rates tend to be less attractive for foreign investment and decrease the currency's value.

Currencies are traded in pairs, for example EUR/USD, AUD/CAD, EUR/JPY and so on. So, in order to visually see the relationship between interest rates and currencies you need to take the difference between the respective country’s bond yields and the corresponding FX pair.

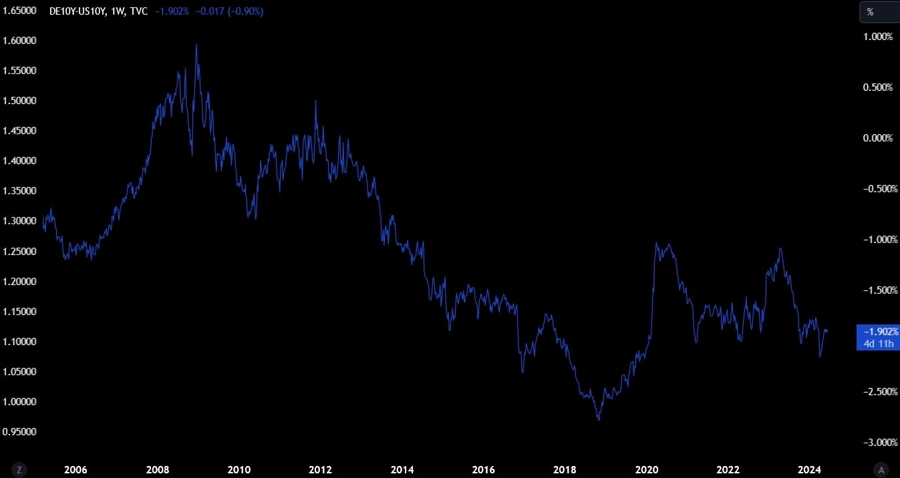

Let’s see an example with EUR/USD. Since you have the EUR as the base currency, you need to take the yield on the German bond (which is used as benchmark for the Euro Area) and since you have the USD as the quote currency, you take the US bond yield. The difference between the yield on the German bond and the US one gives you the yield spread.

Now you just need to compare it with the EUR/USD price chart to see the relationship and you will notice that the yield spread generally leads the price of EUR/USD.

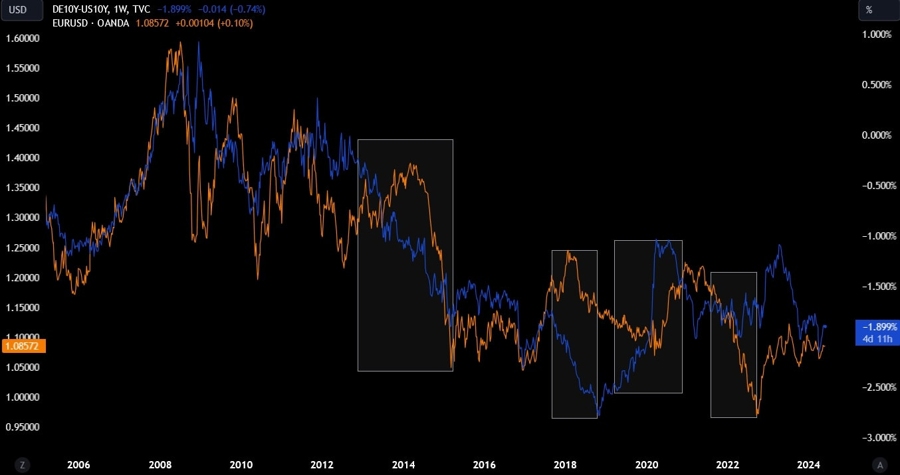

On the chart below, you will see that the divergence between the yield spread and the EUR/USD price chart often led to big swings as the exchange rate caught up with the yield spread at some point. There can be many reasons in the short-term affecting the currency pair but eventually the exchange rate generally follows the spread.

For example, the last divergence was caused by the aggressive Fed tightening in 2022 while the ECB enacted a much slower strategy. Moreover, the war between Russia and Ukraine weighed on the sentiment and increased the pressure on the Euro. The pair eventually bottomed once the market sensed the peak in the Fed's hawkishness.

I personally prefer to use the spread between the 10y yields, but in this case, the spread between the 2y yields (which is more sensitive to monetary policy) would have given a better picture.

Don’t trade just based on the charts and correlations though but look for reasons and keep yourself informed on the latest developments to give you a better edge. When you start to see a divergence, be prepared to strike as soon as the picture changes.