One of the first questions beginner traders ask is what currency pair to trade. Unfortunately, there’s lots of misinformation around and most of the time the advice they get is to trade the most volatile pairs because they can make more money.

That’s of course incorrect because the more volatile a pair is, the bigger your stop loss should be to avoid being stopped out prematurely. In fact, professional traders adapt their stop losses based on the volatility of the instrument. They don’t have a fixed stop loss for everything.

The real answer lies in the fundamentals. If you expect a currency to be strong and another to be weak, then you select the relative pair and buy the stronger currency against the weaker one. You don’t need to trade 5 or 10 pairs if you have conviction on just one. Your job is not to trade, but to make money. You can make a lot of money on just one single pair.

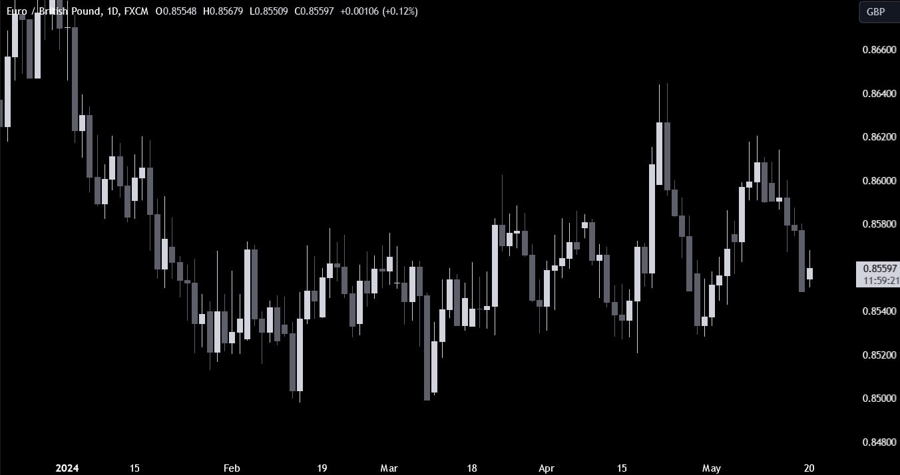

This way not only you increase your chances of success, but you will also have cleaner moves. Take for example the EUR/GBP pair. It’s been ranging for months because there’s not been a real divergence between the ECB and BoE.

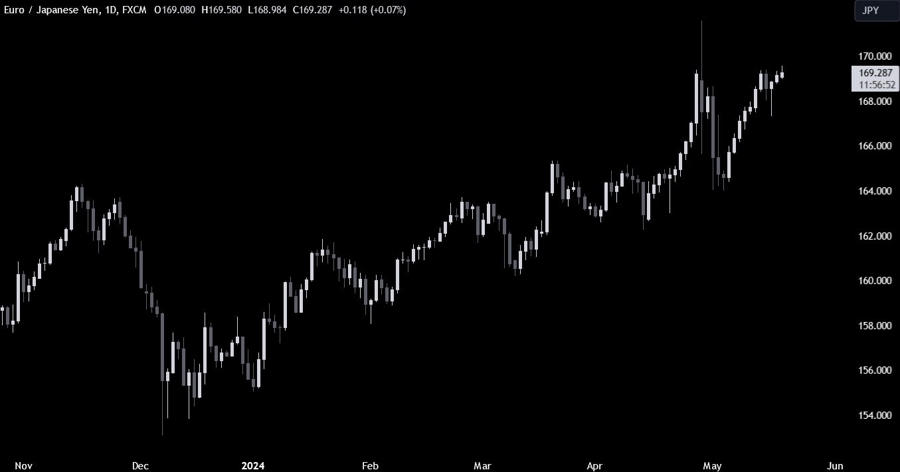

On the other hand, if you look at the EUR/JPY pair you will see that there’s been a steady uptrend as global growth expectations and the hawkish repricing in interest rates continued to fuel the upside.

Don’t select a pair just because of the volatility because more volatility doesn’t mean more profits. You should filter the pairs based on the fundamentals because that’s what will drive the currencies up or down.