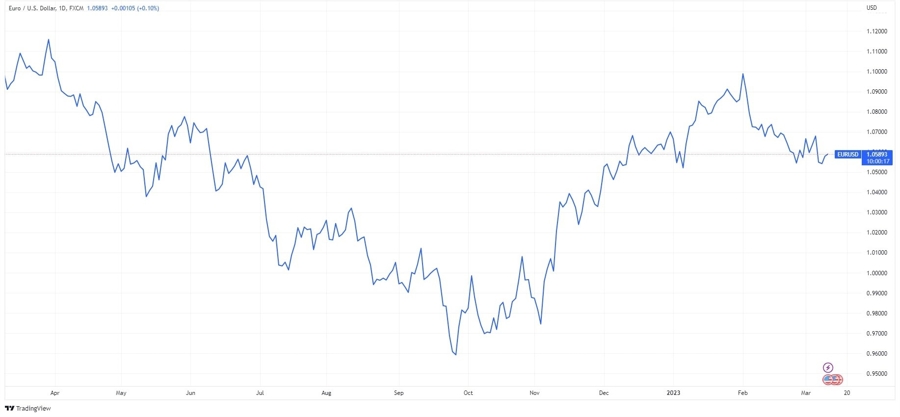

The persistence of inflation in the Eurozone did not go unnoticed by the markets. Not only did EUR/USD exceed 1.06, but also the yields on EU and German ten-year bonds surged by more than 6% over the last 5 days. Judging the circumstances, one should be under any illusions about what lies ahead.

Unless consumer prices surprise tremendously to the downside, investors could remain risk-averse in anticipation of a further tightening of the monetary policy by the ECB. The fact that the regulator's chief economist Philip Lane expects a rate hike after the March meeting as well – does not add optimism.

Overall, the key deposit rate could reach up to 4% this year compared to the current 2.5%. In a research note, Nomura analysts said they expected the ECB to raise interest rates to 4.25% instead of the previously forecasted 3.5%. Thus, sooner rather than later the regulator could beat the record 3.75% rate from 2001.

Speaking of negative consequences, the corporate sector will be amongst the first to suffer. Due to a high level of uncertainty around both economics and geopolitics, issuers are already forced to offer higher bond yields. With that being said, companies' costs could remain elevated.

Eventually, this situation could lead to an increase in defaults. For instance, S&P Global Market Intelligence analysts forecast a surge in the Eurozone speculative-grade corporate default rate up to 3.25% this year, against 2.2% in December 2022. Not necessarily the end of the world, but an inconvenience nonetheless.

In this context, caution must be taken with speculative assets. As for the stock market, the persistence of inflationary pressures could play in favor of value stocks, also known as large companies with a strong financial position and dividends. Growth stocks, on the other hand, have fewer opportunities to rebound.

Finally, yet importantly, it is still too early to give up on the old continent, which is why Stoxx Europe 600 remains in an uptrend. The big question is, will the price pressures start easing in the summer amid slowing economic growth and worsening overall labor market conditions, as some analysts suggest?

In search of clues, markets will follow upcoming economic and data releases (to check the latest market events experienced traders use the economic calendar). This week, for example, investors will focus their attention on Germany's consumer price index, which will be released on March 10th. If the data turns out to be worse than expected, the euro could strengthen against the dollar even further.