Leverage is the dirty little secret of financial markets in the low interest rate era.

Trades are often measured in simple percentage terms but the routine use of leverage magnifies everything. It wasn't always this way but the era of cheap money has led to an infatuation with leverage.

This is most-evident in the bond market where simple returns on nearly everything are negligible but by using high leverage via borrowing or derivatives can lead to impressive returns. Where this goes wrong is when leverage is layered on or assumptions are made about liquidity.

This all came to a head in March 2020 as the pandemic took hold. The standard reaction to a worldwide calamity is to buy bonds and yields quickly fell from 1.6% in the middle of Feb to 0.3% on March 9. However in the days that followed as markets went into a full panic globally, yields shot back higher to 1.25%.

That unexpected spike led to an FOMC announcement that it would buy unlimited bonds in the open market and led to Federal Reserve purchasing more than $300 billion in a day.

Despite some thin reports the Fed never address the root problem: Too much leverage. Instead it doubled down on ultra low rates and printed more money. That enticed traders to use even more leverage.

Over time, the addiction to leverage has spread globally. Before Archegos' Bill Hwang blew up his personal $20 billion fortune and cost Wall Street banks billions, he was running his fund at 5x leverage or more.

The popularization of options trading and derivatives also results in the same thing as leverage. Options-selling firms buy/sell the underlying in the open market in much larger volumes than the cash used to open the trade in order to be risk neutral.

Moreover, simple margin lending is more popular than ever.

This chart doesn't capture all the ways leverage is used but I think it's a good illustration of the the overall trend.

What happens when leverage is removed?

Leveraged trades work until they don't. In a time of rapid market leveraging, everything goes up. That creates more buyers and leverage continues to be added.

Tech stocks were bid up with leverage and call buying way beyond any reasonable underlying value. Down the food chain, leverage was added where ever there were positive returns to be made.

The universe of investments that make sense at near-zero per cent borrowing is nearly unlimited. A security yielding 3% leveraged at a 0.5% borrowing rate 3x is a healthy return.

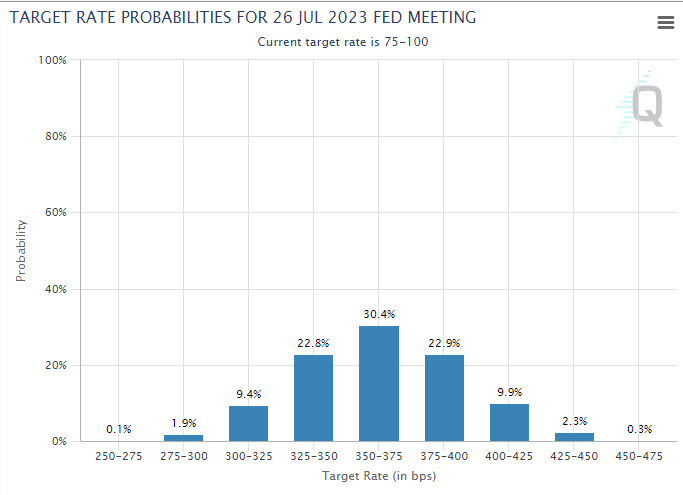

The problem is that market participants are now looking at a market that's pricing in Fed funds at 3.50-3.75% in 15 months.

That would mean borrowing at +4% to finance a 3% return. That's not a good trade.

For now, traders can still borrow relatively cheaply but the people holding leveraged trades now believe they will have to eventually exit. You can sell now or sell when rates hit 3.50%. No one wants to be the last one out the door.

The clearest evidence that deleveraging is the key driving factor in the current market rout is that nearly everything is falling. In a normal time of risk aversion, people would sell stocks and buy bonds. Now they're selling both.

Moreover, options put buying turns leveraged trading on its head, resulting in de facto leveraged selling.

Because of the years of layering on leverage, it will be a painful process in taking it off.

The bottom line here is that the Fed created a Frankenstein of leveraged trading and is now trying to slay the monster without killing the economy.

The overall lack of understanding of how large a roll leverage plays in trading makes me deeply uneasy.