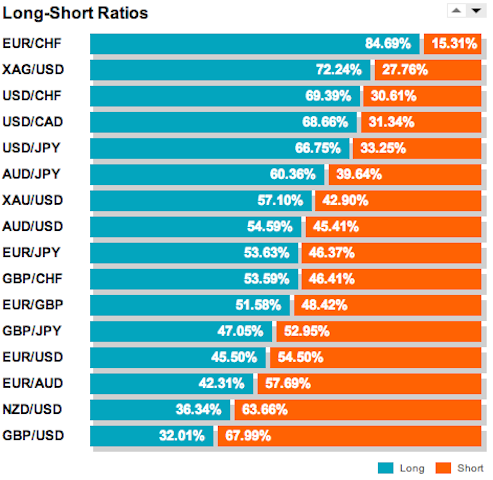

We are always looking for some insight into where the market is heading. A big reason so many of us spend so much time on ForexLive is the comments section. Hearing what other traders are up to and their thoughts help to inform our own. To the end I know many retail traders make significant use of Oanda’s “Open Position Ratios” graph.

I’ve read a lot of comments that go something like “How is EUR/CHF still going down when Oanda has it 80/20 long? I guess it’s only a matter of time before the pop.” I’d like to suggest to you that the Oanda Open Position Ratio chart should be totally ignored. Let me try and put my philosophy degree to use (and please don’t discount my arguments knowing that I paid money for a philosophy degree). (1) Spot trading represent only a minority of the foreign exchange market (2) Retail trading represents a minority portion of spot trading (3) Oanda represents only a minority of forex retail trading (4) Roughly 85% of retail traders lose money; many blow up their accounts ———– (5) Therefore, the Oanda Open Position Ratio chart represents a tiny corner of the foreign exchange market composed mostly of losing traders. Combining (5) with the psychological theory that people prefer to be wrong with the group than potentially wrong on their own, and you have a recipe for negative herding. Better to stay away.