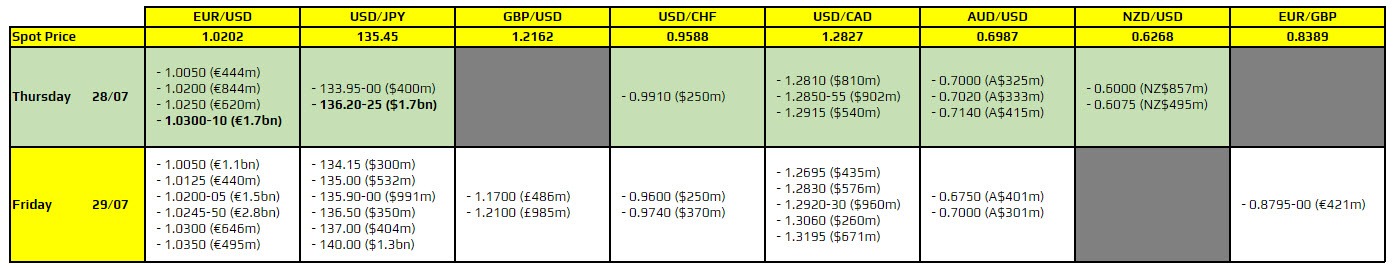

Just a couple to take note of, as highlighted in bold.

That said, they might not be of much significance given that the expiries are trading some ways off from the current spot price. In the case of EUR/USD, price action remains somewhat capped by key resistance from the 50.0 Fib retracement level at 1.0283. That remains a big level to watch before getting to 1.0300-10.

Meanwhile, for USD/JPY, the softer price action today in the pair as a result of a dollar drag from the Fed meeting yesterday may see it hard for the expiries to really come into play. More so as it would seem that sellers are poised to try and push the agenda towards a test of the lower bound of the 135.00 to 140.00 range.

In any case, just be wary that there are significantly large expiries for EUR/USD tomorrow between 1.0200 to 1.0250 so that could well keep price action more anchored around those levels in the sessions ahead. But we will have US GDP data later today in terms of risk events, so keep that in mind as well.

For more information on how to use this data, you may refer to this post here.