Hats off to a fine bit of jawboning from RBA governor Stevens who did what all sneaky merchants do and kicked a man while he was down.

10/10 for jumping on an opportunity to ram a point home and get the desired effect. Super Eamonn had his number well before he opened his trap.

Has anything changed though?

The problem with talking a currency down is that it is an expiring commodity. If the fundamentals show a different picture to the one you’re trying to paint the market is going to slowly ignore you. It did on the way down to 0.87 and it will again here.

As always though, the key is trying to find that expiry point to play your orders at.

There may be some value in longs here as we’ve had roughly 130 pip fall from 0.9500 in a day but there’s a strong possibility that the pair will carry an offered tone for a while from here. Certainly at the very least I expect heavier selling up towards 0.9500 than there may have been previously.

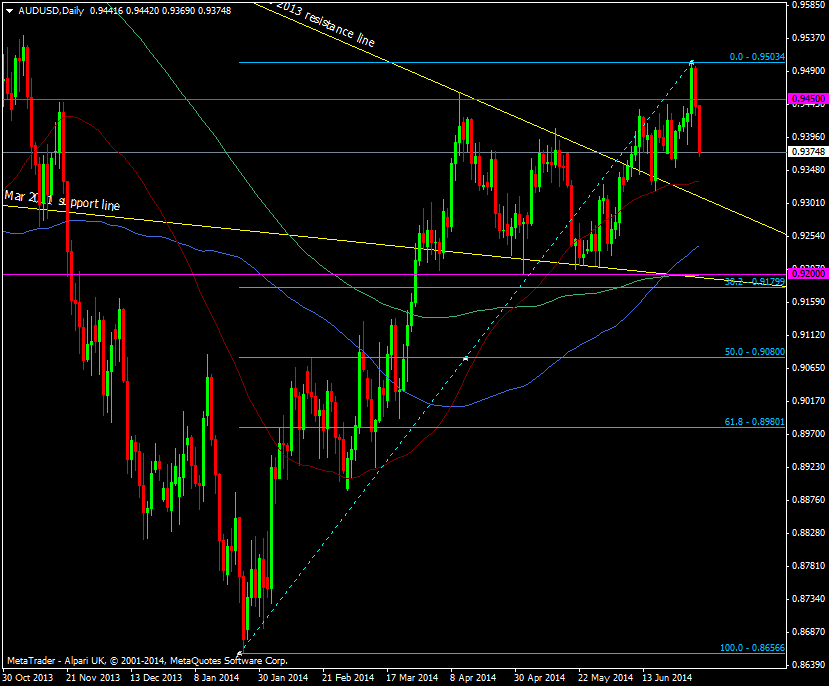

AUD/USD daily chart 03 07 2014

I’d prefer to wait for better value on a long trade and seeing if the sudden shock draws us down to better levels to re-load longs. The first area is around the 55 dma at 0.9330 and the broken Oct 2013 resistance line at 0.9312.

The area I really like though is the confluence of tech around 0.9200. We have a strong support point, 200 dma, March 2011 support line and just under all that the 55 wma at 0.9186 and the 38.2 fib of the 2014 lo/hi at 0.9180.

That’s a nice big juicy pile of support and I’m hoping that the RBA talk it right down to that level so I can load up.

Central bankers love their keywords and Stevens looking to change various phrases in an attempt to lower the currency is music to my ears. We know Australia isn’t in trouble. Yes there are risks but there were risks when the currency was tumbling down to 0.8700. There’s always risks which is why we watch the data and watch the sentiment.

Unless the RBA back up the talk with actual actions then I’m still a big Aussie bull and I’ll fight them all the way, again.