Like the other currency pairs, the EURUSD has gotten a boost from a surge of selling in the US dollar. For this pair, the price held the support outlined in an earlier post against the 100 and 200 hour MAs and “the quiet” (shhhhhhh) led to some buying excitement. The holding of those technical levels and subsequent move away is what you would hope for, and what happened. At the heart of the trade was that risk was defined and limited. Risk was not triggered. Reward ensued.

Now what?

EURUSD makes a break higher. Trades at highest level since September 4th

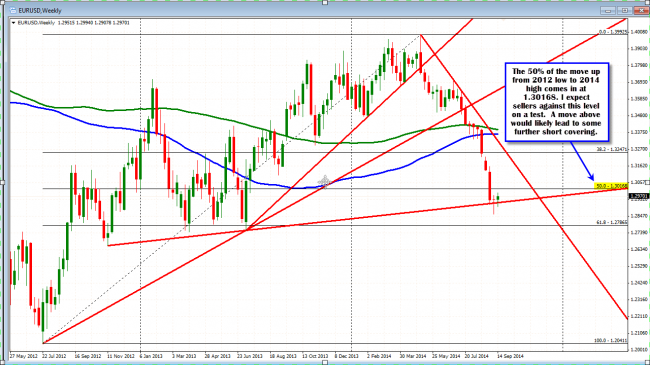

As per the prior post, the next target comes in at the 1.30087 which is the 50% of the move down from the high from last week (before the ECB tumble ). I would expect sellers to enter against this area as there is bigger resistance at the 1.30168 level. This is the 50% of the EURUSDs move higher from the 2012 low to the 2014 high (see level on the weekly chart below). If the price bias is to remain bearish for the pair, I expect this level to find sellers against it – at least on the first test.

On the downside it would be nice to see support against Friday’s high, or at least against the high from earlier in the day (see hourly chart above). You waited all this time to make a break higher, at least extend to the next target level?

EURUSD has the 50% of the move up from the 2012 low to the 2014 high. I would expect sellers here if they are to remain in control.