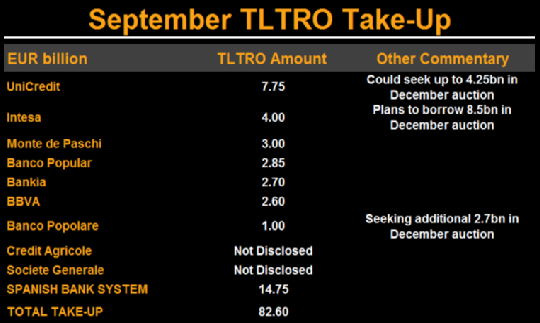

Banks borrowed just €82.6 billion in the first of the highly-touted TLTROs.

The long-term lending program was always the corner stone of the ECB’s plan to get money back into the system but the unwillingness of banks to take loans at the rock-bottom rate of 0.15% is worrisome.

One line of thinking is that the low demand for cheap funds is a sign that European banks are healthy but that hardly reflects reality. Loan origination is stunted, banks are struggling to raise capital and the economy is flat.

Perhaps there’s a stigma but if I’m an investor in any company that can get a 0.15% loan, I want them to take it. So I find that excuse hard to believe.

At best you can say there were some jitters about the first program, even though it was hardly rushed after it was announced in the Spring. If the December TLTRO is similarly sluggish, I don’t see a path for the ECB to get to a €3 trillion balance sheet without resorting to sovereign QE.

Add in Banco Santander at 3.6B. German and French banks not disclosing. About 40% of the total went to Spanish and Italian banks.

There’s some talk that banks are waiting for stress test results before jumping in. They’re due in October.

The worst-case scenario is that there just isn’t demand for loans in such a weak economy. That would mean the eurozone is virtually doomed to stagnation.

Bottom line: It’s hard to see a path for euro gains in any of this. The market is giving the euro one free pass on the poor take-up but that won’t be the case in December.