Preview of the ECB governing council meeting 4 December 2014

After this ECB meeting Dragi and his ECB entourage can pack up for a six week break as it will be 22nd Jan 2015 before we hear from the governing council again.

The big question is what sort of present will they leave us? Can we expect a big shiny glitzy wrapped box of goodies or will the fabulously wrapped box be empty?

I think it’s safe to say that we won’t get any actual policy action, and there’s next to no one in the market expecting otherwise. The risk is that we get the full menu of delights that the ECB can use next year, or nothing at all.

From many of the ECB members spouting forth recently, we know we’re still data dependant and what happens in the first quarter looks to be key for what the ECB do next. We’re still in ‘wait and see’ mode.

For Draghi himself, we know he likes to “tip the nod” to policy action and in this case I think he’s going to give us a rundown on what they’ve got in store. Previously he told us that the ECB staff were working on the “new measures” and it’s been a while so the brainboxes must have cobbled together a plan by now. If we they haven’t then the market is going to throw a strop.

What the market will do if Draghi doesn’t deliver

We’re facing a potential OMT moment for QE where we could get all the details of what, whom, and where the ECB are going to act. If we do, I think we’re going to get the kitchen sink on it. Corporate bond buying, sovereign QE, the lot. This could be the ECB tipping the tool box out on the table and saying “There you go, that’s what we’re ready with”. It will be an OMT moment because we could well get a template of action that will send the market moving a huge amount, in stocks, currencies and bonds. The OMT announcement is said to be the one that saved Europe and so far it’s been nothing more tangible than words and a court appearance. The same effect will be felt by Draghi uttering that full on QE is ready to go.

At the least Draghi will look to buy the ECB some time and so QE talk giving the euro another 200-300 pip kick down between now and the next meeting will be the perfect Christmas present for the eurozone. Weak oil prices, weak currency, all the ducks lining up to give the economy an early boost in 2015.

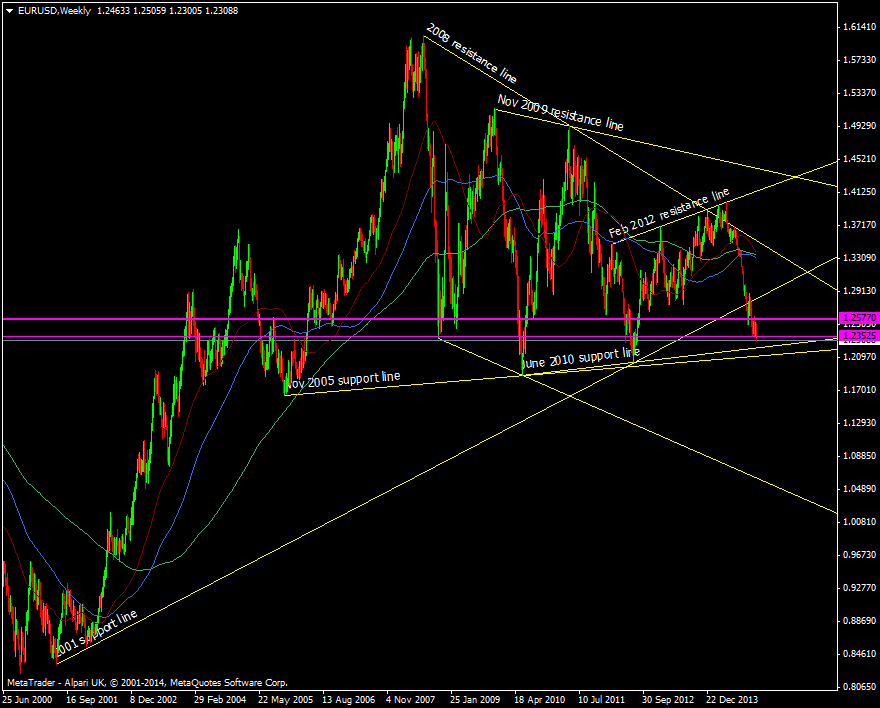

Now for the all important trading part. The latest drop in the euro says that the market is expecting something. If QE talk happens then unless you’re already short going in, you face the prospect of trying to chase it lower. Not a good idea unless you get in quick enough. Probably the best opportunity is if we get nothing and the euro pops higher giving a better level to load up shorts. In that case the recent range tops at 1.2500/75 will probably contain a rally from here at 1.23.

Below, the 1.2225/35 level containing the July 2010 support line and the 200 mma is the first target, and that might be strong enough to contain mild mention of QE but will be unlikely to contain stronger wording. Under there is the Nov 2005 support line at 1.21 then the big fat 1.20 number.

EUR/USD Weekly chart

There’s lots in the balance and news could come either in the statement or the Q&A after, cos that’s how Draghi rolls. Whatever happens, Draghi is preparing the big guns and may soon be ready to roll.

QE-bot Draghi – The markets ‘must have’ toy, ready to fire euros across the eurozone