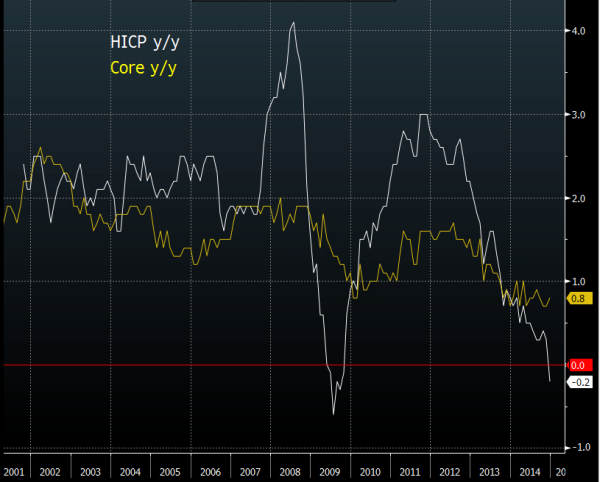

Sorry, it’s not deflation it’s disinflation don’t you know?

2009 was the last time we were here and inflation bottomed at -0.6%. Over that period the core held above 1% until the end of 2009 where it bottomed at 0.8%

Eurozone HICP & Core yy 07 01 2015

Of course there was a whole different set of circumstances back then but Europe is finding itself in a similar story once again. The biggest question for Europe right now is whether they can make something of this low inflation environment. It should be an economic booster but the problem lies in whether there’s enough activity to take advantage of it. If there’s not then that’s going to spell big big trouble for Europe and they could really be facing their “Japan” moment.

As for the ECB, that core number just might put them on hold this month. Price stability is their mandate and a small tick up in this environment is bigger news than it looks. That said, the effects from lower energy costs will be lagging well behind the core figure, as you can see in the chart above. If the core starts to join the headline down the chute then get ready for some QE. If I had to pick a number I’d say 0.5% or under for the core will get them pulling the trigger.

Roll on Jan 22nd