In case you missed it, the results are here: Australia Q1 2014 CPI – all the results & what it means for the Australian dollar

—

Warren Hogan, ANZ Chief Economist:

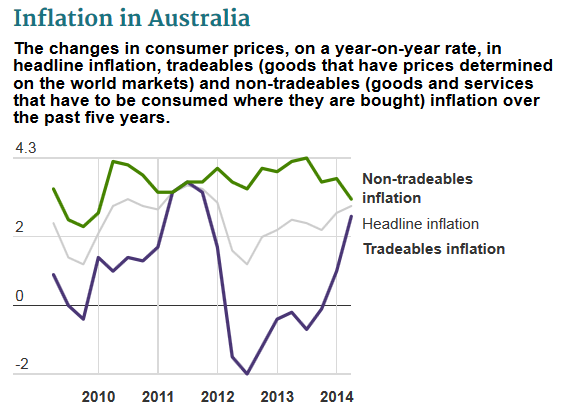

- low CPI reading will be welcomed by the RBA after the high Q4 reading esp. as it showed a moderation in non-tradables inflation

- will allow the RBA to continue to pursue the current very accommodative monetary policy setting “to buttress the economy from the expected drag on growth from weaker mining investment and tighter fiscal policy.”

- CPI data does not change our rates view. We expect cash rate on hold in 2014 before gradual rise in 2015

- “We continue to see the current gradual recovering trends in capacity utilisation, job advertising, hours worked and business conditions as supportive of the view that rates will not move up especially soon and will only move up gradually through 2015,”

Shane Oliver, Head of Investment Strategy and Chief Economist at AMP Capital:

- Relief!… Underlying measures also benign

- March quarter CPI indicates the higher than exp Q3 & Q4 CPIs were an aberration & inflation remains benign.

- No pressure for early rate hikes here

MNI (RBA watcher Sophia Rodrigues)

- Interesting that Australia Q1 Tradable CPI slowed despite impact of tobacco price rise which was the most significant increase

- Non-tradable inflation also slowed

- The outcome suggests there has been slowing in non-tradable components outside of administered prices such as education, healthcare and utilities

- “The latest data shows that some of the rise in Q4, when inflation was above expectations, was noise and this will now comfort the RBA. However, with underlying inflation running above the mid-point of the RBA’s target band, it remains to be seen whether the RBA resumes its easing bias, or just steps up its rhetoric on the exchange rate as Westpac economists expect.”

—

Not an analyst, from the Australian Bureau of Statistics:

———–

CommSec – Craig James, Chief Economist:

- Inflation is under control. Underlying inflation was 0.5% in March quarter and 2.7% over year.

- No need to change rates either direction.

Ben Jarman, an economist at JPMorgan:

“The coast is relatively clear on the inflation front for the RBA to keep rates low. On the inflation front itself, things look relatively benign still.”

Michael Turner, a strategist at RBC Capital Markets:

- “That high Q4 reading just never fit with weak wage growth and rising unemployment. Today’s data show the underlying pulse of inflation is not that strong. Market prices ex-volatiles were actually flat in the quarter and inflation in services moderated.”

Peter Dragicevich, a currency strategist at Commonwealth Bank of Australia in Sydney:

- “The CPI number undershot most analyst expectations and that’s put the Aussie under some intraday downward pressure. It shouldn’t change the fundamental backdrop for the Aussie and we don’t think this move will extend too much further. Good support will probably be found down toward 92.47 cents.”

Westpac:

- This result will therefore mean a number of important things for the RBA:

- There is going to be limited implication for inflation if the AUD was to ease off back towards USD 0.90 from current levels

- The economy might not be as strong as they had expected – note that IMF forecasts (largely provided by Treasury) are lower than recent RBA forecasts

- There would appear to be little risk in restoring a stronger rhetoric about the AUD

- We expect that the AUD will revert back to our USD 0.91 target by June but, if that traction is not achieved over the next few weeks, the Governor may well restore the “uncomfortably high” language

- However, given the more encouraging domestic data on consumer spending, housing and employment it will not restore its easing bias.

- Westpac retains its call for the rates to remain on hold until the second half of 2015.