ANZ with a look ahead to the week, with the preamble that:

the last two weeks confirmed the USD has likely bottomed:

- with the market still positioned relatively short, we think that further upside is likely

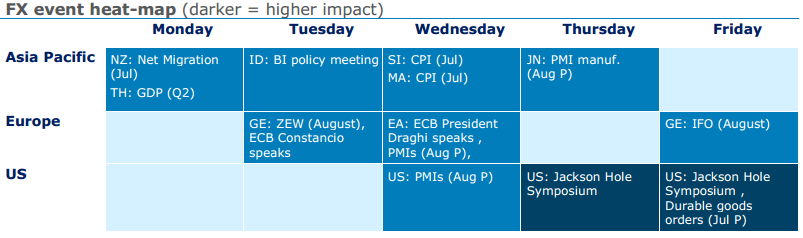

- This week, the conference at Jackson Hole will take centre stage

What to expect at Jackson Hole:

In his speech at the Jackson Hole meeting this week, ECB President Draghi is expected to give further sign of ECB's growing confidence in the euro area economy.

- However, while the meeting is largely seen as a favourite spot for central banks to send signals, Draghi is unlikely to shift his policy language just yet.

- While Draghi may disappoint at Jackson Hole, the ECB is widely expected to make an announcement on the future of QE at its September's meeting - meaning that any dip in the euro should be seen as a buying opportunity

Fed Chair Yellen is talking about financial stability and is likely to reinforce New York Fed President Dudley's message of earlier this week that a rate hike for later in the year remains on the table.

- Momentum in the US economy is picking up, with the economic surprise index starting to grind consistently higher, and sentiment towards the USD is already changing.

- Combining the current positioning with the Fed's conservative pricing, the USD may be due for a sharp rally.

"... Gonna mess around!" .... riiiiight .... ;-)