Bank of Canada abandons its current core CPI measure

The Bank of Canada will develop three new core inflation measures as it aims to meet its 2% inflation goal.

The headline from today's mandate announcement was that no change would be made to the 2% target but what is going to change is how 2% is measured.

The current BOC core is called CPIX and it excludes fruit, vegetables, gasoline, fuel oil, natural gas, mortgage interest, intercity transportation and tobacco products.

"In recent years, the usefulness of CPIX inflation as an operational guide to policy has deteriorated," the BOC writes.

They note volatility in energy prices and counter-cyclical moves in things like auto prices.

"Since monetary policy primarily acts on inflation through its effect on demand, measures of core inflation that move with the output gap and are largely insensitive to transitory sector-specific developments would be more effective as operational guides to policy," the BOC writes.

That's an impressive leap. The problem is that consumers are paying for all types of inflation, not just the demand-based ones.

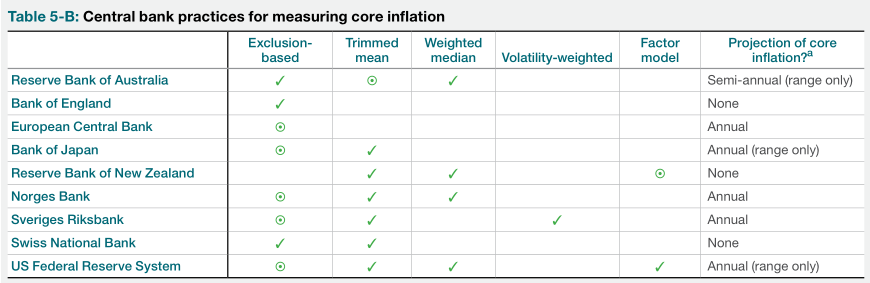

In any case, the BOC evaluated different inflation measures and decided on three new ones.

Here are the BOC explanations of the three new categories:

CPI-trim (trimmed mean) is a measure of core inflation that excludes CPI components whose rates of change in a given month are located in the tails of the distribution of price changes.

CPI-median (weighted median) is a measure of core inflation corresponding to the price change located at the 50th percentile (in terms of CPI basket weights) of the distribution of price changes in a given month.

CPI-common (common component) is a measure of core inflation that tracks common price changes across categories in the CPI basket.

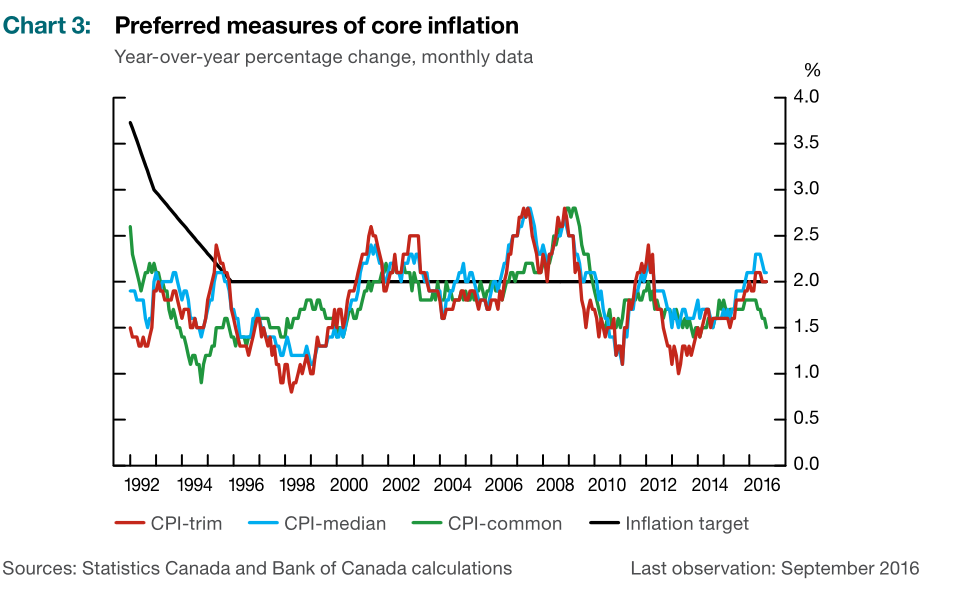

Note that all three are beginning to roll over, especially CPI-common, which seems to be the one the BOC likes best because it says it follows the output gap and is best on persistence.

Those recent declines may be part of the reason the BOC has shifted towards cutting rates.