Bank of America Global Research discusses the trajectory of the Fed policy path, this via eFX.

For bank trade ideas, check out eFX Plus

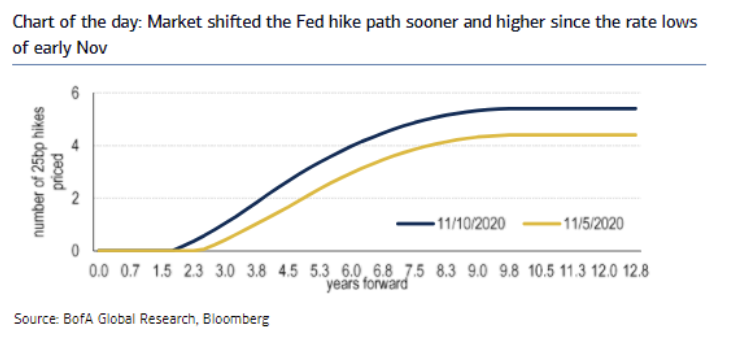

"Fed Chair Powell famously described the Fed's policy stance in June as "We're not even thinking about thinking about raising rates." But the market is thinking about it, and we are starting to see that dynamic come back in play driving 10y rates higher," BofA notes.

"While it seems almost crazy to imagine the Fed hiking rates, the fact is that 10y rates incorporate Fed policy expectations over the full span of the next 10 years, and it is not unreasonable to imagine the Fed embarking on a hiking cycle within 3 or 4 years of today, or even sooner if everything goes right with the pandemic and the economy. Currently, the market is pricing the first hike by 1Q24. The hikes priced into the second half of the coming decade materially impact the level of rates today," BofA adds.