One cut but followed by a hike later

What's more important? Whether the Fed cuts one, or whether it continues to cut?

I would argue it's the latter but the market is often focused on the first part of the equation. I'm reminded of a quote from former St Louis Fed President Bill Poole:

Poole believes people in the press and financial markets are usually asking the wrong question. 'What is important is not the policy action at the next FOMC meeting,' he said, 'which is typically what people want to know, but the policy regularity that will extend across many FOMC meetings, which is what people should want to know.'

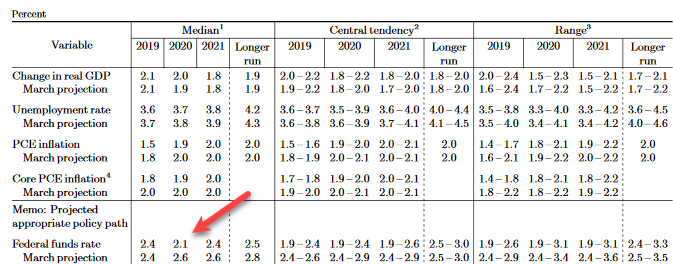

The Fed forecasts signal lower rates next year and the median was close to showing the same this year but there's an open question about whether that will be an insurance cut or the start of the cycle.

The other side of the argument is that every journey begins with the first step so whether it's four cuts or one cut; it starts the same way. The Fed also has a long history of over-optimism.

The other interesting change is on inflation, where there is a solid downgrade this year to 1.5% and a range of 1.4-1.7%. That's worrisome and well-below target. The forecasts show a recovery next year but some Fed members include a rate cut as part of that equation, so it's not necessarily representative.

Overall, the market has probably gotten it right here but I wouldn't sell the dollar here because there's a good chance that Powell highlights some of the good things in the economy, and that confuses markets.