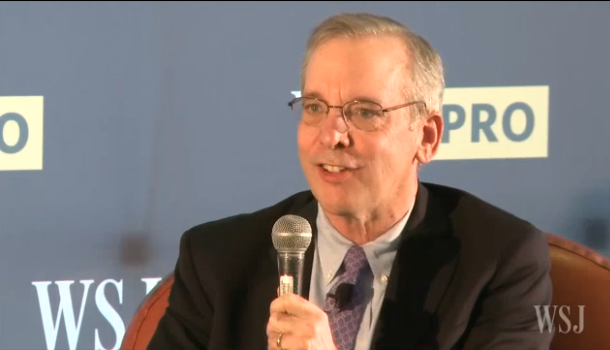

Fed's Dudley speaking with Jon Hilsenrath:

- Sees value in pushing unemployment below natural rate

- Economy is doing pretty well

- Expects the Fed to hike later this year

- It's not possible to say what would cause him to support a hike

- Cites financial conditions and global growth as factors for rates

- October FOMC meeting is a live meeting

- Monetary policy isn't as easy as people thing it is

- Equilibrium real interest rate now close to zero

- "If policy was truly accommodative, then why is growth so low?"

- If financial conditions tighten after first hike, we'll more slowly

- Don't expect mechanical approach to policy tightening

- Chinese growth a big issue for global economy

- The world is not a certain place, things change

- Don't see high financial stability risks at the moment

- We are confident on inflation expectations but not 100% sure

- Inflation likely to rise in medium term, downward pressure on inflation from strong dollar likely to abate

- Fed to be flexible on size of overnight reverse repos at liftoff

- 'Highly confident' that Fed can hold the floor on rates

- My opinion is that limits on overnight reverse repos shouldn't exist

The interview is live on WSJ's new central banking pro site.

Here he is giving the finger-point head wag. Strong move.

Dudley talking about rate hikes this year is hawkish. The Fed funds market is around 42% for a hike this year and Dudley isn't usually one to talk up the possibility. USD/JPY jumped to 120.26 from 120.05 on the headlines.