It's something that needs to be repeated

Some of the smartest professors, economists and traders have no idea about how the banking system works.

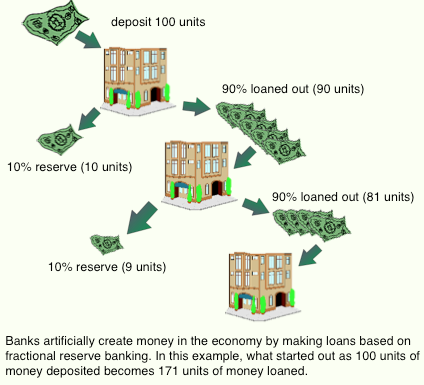

It goes back to the textbooks. The myth is that you deposit money at a bank, then that money is leveraged and lent out by the bank. So your $100 at the bank is held in reserve and used for a $1000 loan.

It makes for nice theories on money multipliers, the velocity of money, credit and inflation but it's all wrong.

It's an important topic today because the Swiss are voting on the Vollegeld proposals on the weekend, and they're driven in part by this misunderstanding.

The reality is that bank lending is demand based. Banks simply expand their balance sheets when someone comes in and ask for money. If they don't have it, they borrow it from another bank or the central bank. Lending standards and capital requirements are what restrains lending, not the amount of deposits. Canada, Sweden, Australia and others don't even have bank reserve requirements.

Cullen Roche has been on a crusade for years trying to correct this myth, which is even repeated by Nobel prize winners.

In short, this is a myth: