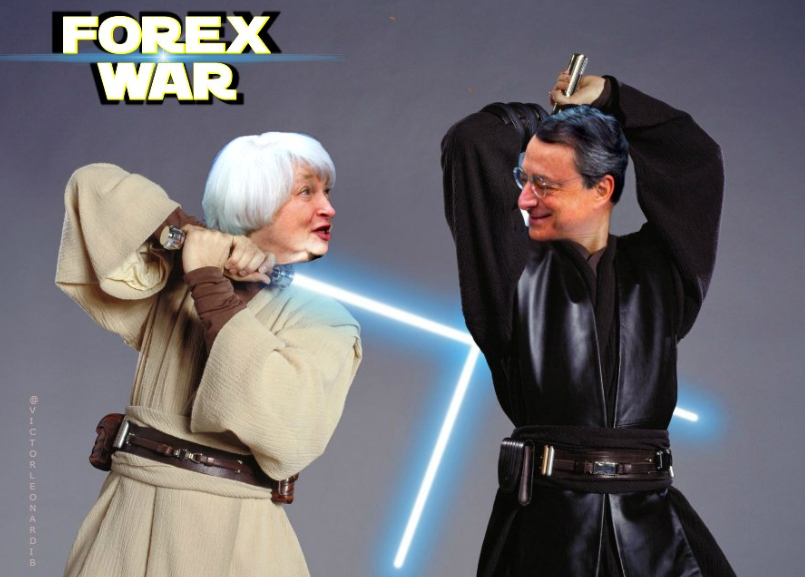

It should be a EUR vs. USD battle at the central banker symposium with contrasting speeches from the ECB and the Federal Reserve

Both European Central Bank President Mario Draghi and Fed Chair Janet Yellen are to give speeches, Adam posted on the prospects for Yellen's speech, fearing it might be a bit of snoozer:

- a clue in the schedule suggests it might not be Yellen who makes a splash. The topic of her speech is 'financial stability' which is the kind of thing that often focuses on regulation.

I said back on Friday I suspect this might be code for speaking on balance sheet reduction

Even this might not be enough to keep us from nodding off though:

- At this point, most expect a September announcement to be a formality and the start of the program to be smooth.

But, what about Dr. Draghi? The Wall Street Journal over the weekend said Dr. D could become the symposium's centre of attention:

- ECB watchers think his coming appearance will give him an opportunity to review the evidence and set out the case for bringing (QE) to an end in 2018

Citing:

- a substantial fall in unemployment (In June, the eurozone's jobless rate fell to 9.1%, its lowest level since February 2009)

- Economic growth has also strengthened

- There has also been some progress toward meeting the ECB's inflation target

(WSJ article is here for more, may be gated:

Mario Draghi Is Likely Lay Out End to Europe's Quantitative Easing

In return to Jackson Hole, ECB chief brings signs of progress on policies introduced there)

--

I reckon the Journal is on shaky ground with the EU inflation point. And the unemployment rate might have fallen, but 9.1% is hardly high-five territory.

We'll (ForexLive) have more to come on JHole ahead of the chatfest.