The central bank rundown

The weekend is a perfect time for a quick catch up for where the major central banks are at. The central banks will be listed with the most bearish central bank first which will be, drum roll please, and no surprise it's the Bank of England winning the current battle of the bears

Bank of England: Most Bearish central bank

The single cloud which obscures the BoE's view is Brexit, or more specifically, the chance of a no-deal Brexit. Over the months the belief that Britain would get a deal out of the EU has changed with the growing realisation that a no-deal Brexit may be impossible to avoid. Boris Johnson's new approach of ensuring that Briatin leaves the EU by October 31, with or without a deal, is now being taken seriously by the markets. My view is that a deal will be struck, only after the event of a no deal. However for now the BoE is unable to assess the incoming data properly. Recently wages have stood firm, CPI was good across the board, UK retail sales were robust,but UK Q2 preliminary GDP was a miss at -0.2% vs 0.0% q/q. All in all not too bad a data set, but for now expect GBP sellers on rallies as the GBP takes the top spot for the most bearish central bank with a no-deal Brexit at the front of investors minds.

European Central Bank: Bearish

The market expectations are now for the ECB to ease by 10 basis points in their September meeting. There is also the potential for a tiered rate system, which stops every day savers paying to save their money, and a new round of asset purchases. Since the ECB signalled this easing bias the German economy shrank by 0.1% QoQ from 0.4% QoQ in the first quarter. This means that the EU's powerhouse has shown a stagnating economy since 3Q 2018. The data prompted the German Economy Minister to say that the Q2 GDP data was a 'wake-up call' and a 'warning sign'. Expect EUR sellers on rallies.

Reserve Bank of New Zealand: Bearish

The RBNZ cut interest rates by a surprise 50bps at their last rate meeting. Governor Orr was very bearish in his language at the press conference and he didn't rule out the RBNZ needing to take further action. He saw negative interest rates as an option and even the prospect of QE. It was a great opportunity for a quick leveraged NZD short, so worth noting a surprise interest rate cut fora decent opportunity as I flagged a few hours after. Since Orr spoke at the presser, there has been a New Zealand Treasury paper stating that the RBNZ could reduce the interest rate to -0.35% (currently at 1%) , but that QE was seen as a less appealing tool. Expect sellers on NZD rallies with the RBNZ's bearish outlook

Reserve Bank of Australia: Bearish potentially turning neutral

The RBA is at an interesting point having cut interest rates in back to back meetings this year (after an extended period of being on hold). The RBA have lowered their GDP growth forecast and inflation forecasts adding that their economic forecasts assume rates will move in line with the market pricing to 0.75% by year end and 0.50% by H1 2020. However, the data has been generally robust for Australia and Governor Lowe spoke of the economy being at a possible 'turning point'. See a piece here I reported on Wednesday in the week about the divergence between Australia's OECD leading indicator and the value of the AUD. The strong July employment data on Thursday helped and just after the data the odds of a 25% rate cut by the RBA are now seen at ~23% vs ~50% at the start of the week. One final aspect to mention is that the Australian economy is closely tied to China's fortunes with apx 30% of its GDP coming from trade with China. Therefore, AUD will be pushed or pulled along with the US-China trade sentiment too.

Federal Reserve - Neutral to weak bullish

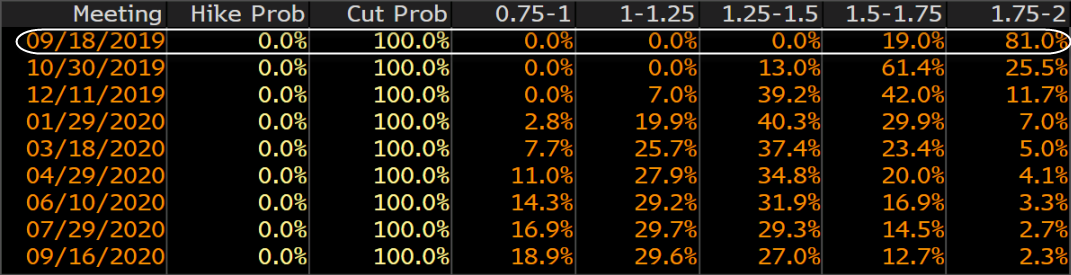

Mid-week, after the Trump administration announced a delay to tariffs, Justin reported that the Fed funds futures scaled back on the 50bps rate cut with odds falling to 19% from 31% in the week.

Justin made the point that you have to wonder whether or not the markets are getting too ahead of themselves in pricing such a move with the US and China hitting the brakes on further escalation for now. He went on to point out the relatively strong domestic picture means that the Fed could end up shifting to a more neutral position at next week's Jackson Hole symposium. However, in only one day that risk sentiment changed as the market went into full melodrama. Risk is elevated and fear is clouding reality. So, this is hard to call. Will calmer heads prevail as the US economy is in good shape, and the Fed can hold rates for now, or will the Fed go along with the panic and cut 50bps at the next meeting?So, the Fed is one to watch as it may be on the point of shifting to a more neutral perspective. If it does shift, expect dollar strength.

Bank of Japan - Neutral to bearish (but JPY is bullish!)

The reason that the JPY is bullish is that the Yen has been bought for its safe haven status on a number of ongoing risks. There is a risk of a no-deal Brexit, US-China trade tensions, slowing global growth concerns and political risk out of Italy. All of the above have kept JPY bid. However, the Bank of Japan are very bearish as a bank. Inflation in Japan continues to miss the 2% target and the BoJ have stated that they will 'keep very low interest rate levels for an extended period of time' until at least through spring 2020. Eamonn posted in the week that JP Morgan's reported that they consider that the Bank of Japan has now shifted to a 'pre-emptive easing stance' and that the 'BOJ is now willing to ease in response to risks of weakening momentum, rather than waiting for hard evidence'. Reuters reported that 30 out of 38 economists see the BOJ's next move as being ready to ease policy. The 100 level is seen as the 'line in the sand' level at which the BOJ will be ready act. The sub 105 will see verbal intervention. So, if the JPY is bid any further on some risk factor then expect to see some response from the BOJ.

Swiss National Bank- Neutral to bearish (but CHF bullish)

The CHF is being bid on exactly the same reasons that the JPY is being bid;as a traditional safe haven currency. The SNB interest rates areat-0.75% and haven't changed at a scheduled meeting since 2009. However, with the strengthening Franc hurting the Swiss export economy a number of large institutions, like UBS Group, Raiffeisen Bank International AG and Bank J. Safra Sarasin,have recently called for a rate cut at the September 19 meeting. This is as the Swiss franc increases more than 4% versus the Euro over the last three months. However, the median forecast is still for the SNB to remain unchanged.Expect CHF strength (like the JPY) on ongoing risk off concerns

Bank of Canada- Neutral

The Bank of Canada remains the only major central bank to not turn explicitly dovish. However, in an increasingly bearish central bank world the pressure is increasing on the Bank of Canada to follow suit. Canada is the fourth top exporter of Oil behind Saudi, Russia and Iraq, so the recent downturn in oil pricesfrom $60 in mid July down to a low near $50 in early August has been an extra weight on CAD. The recent domestic picture has been less robust too with July's Core MoM retail sales disappointing at -0.3% vs +0.3% expected and the last employment data showing a decrease at -24.2K vs 15.2K expected and an uptick in unemployment at 5.7% vs 5.5% expected. This means that the Bank of Canada is in a neutral position and its next move will likely be decided for it by global growth sentiment aiding or hindering oil prices. Keep an open mind on CAD for now

So, ForexLive readers, I hope this is helpful as a quick rundown on where we are at with the world's major central banks. Have a great weekend!