The Monetary Authority of Singapore (MAS), Singapore's central bank, meet twice a year on policy.

- In October and April.

The April Monetary Policy Statement will be released at the conclusion of the meeting. While a firm date for the April meeting has not been disclosed, it will be no later than April 12.

What to expect? Preview (in brief) via ANZ:

- The case for further policy tightening … is weak, in our view.

- With Singapore's economic growth slowing to trend, the MAS Core Inflation showing signs of easing, and risks to the global economy tilted to the downside, we expect no change to the slope and width of the policy band or the level at which it is centred.

- However, this is only a pause, and not an end, to the MAS's policy normalisation cycle. We certainly do not expect the MAS to join the dovish turn seen among other central banks recently.

- We believe that overall policy settings are still below neutral levels, and further policy tightening down the track is likely when growth recovers and domestic inflation pressures emerge again.

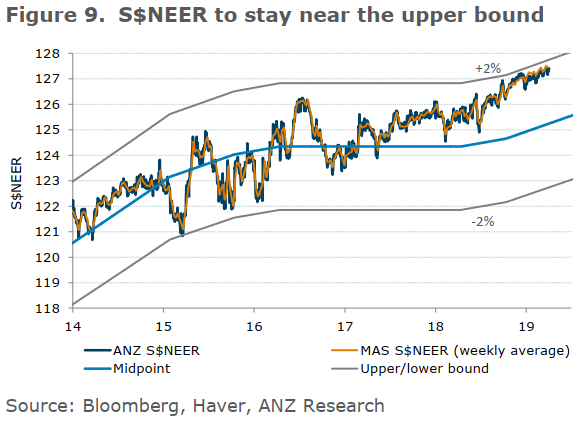

- We expect the S$NEER to stay close to the upper bound of the policy band. With the policy slope at 1% per annum, this provides scope for the Singdollar to continue outperforming the currencies in the basket.