Bloomberg reporting an article from newspaper Schweiz am Sonntag published today

- calculations show that the Swiss National Bank could post a 2015 loss of CHF 30bln due to the franc's appreciation

- amount would be 5% of Swiss GDP

- government and cantons may not receive customary payout

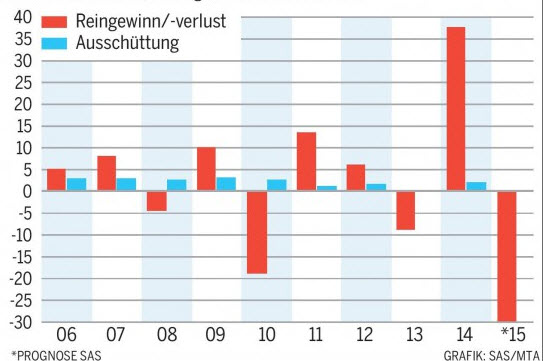

SNB profit & loss (CHFbln)

The table above shows the sharp reverse from a record profit in 2014 of CHF 38bln

The SNB forex reserves totalled CHF 563bln at the end of November and can be assumed to have grown since, given the on-going intervention to weaken the franc/prevent further appreciation. Some of these H2 currency purchases will be showing a profit given the rises in many CHF pairs and the full year results will be less than the half yearly CHF50bln loss reported

Last week I posted that SNB president Thomas Jordan was unrepentant about removing the cap, a monumental decision which nears it's first anniversary on 15 Jan.

The full story from SamS is damning of the SNB and can be read here ( English translation)and they further report that the SNB will publish initial results on 8 Jan

No doubt Jordan & Co will once again defend the SNB's decision and reiterate their determination to intervene. Indeed he could point to the improvement from six months ago but it's all relative and he will still have a job convincing the SNB shareholders whilst asking for the patience and understanding from Swiss exporters. In the Nov trade balance data we saw a reduced total of CHF 3.14bln with exports down sharply, led by a 5.6% yy decline in watch sales.

SNB's Jordan- Going to have a lot of explaining to do. Again