Canada employment data due at 8:30 am ET (1330 GMT)

Nonfarm payrolls get all the hype today because they always get all the hype. There is reason to believe the US jobs report will be unusually weak and probably even more reasons to believe it will be strong.

(Be sure to pick a number in our non-farm payrolls contest)

Either way. It's not a big factor for the Fed. One weak jobs report would change nothing about the strong underlying jobs momentum. There is little argument that the US is at least close to full employment. I'd argue that average hourly earnings are even more important than the headline (earnings expected +0.2% m/m).

In Canada, everything is on the table. The Bank of Canada could cut rates as early as January 20. Rates could go negative this year if the pain of the commodity collapse hits hard.

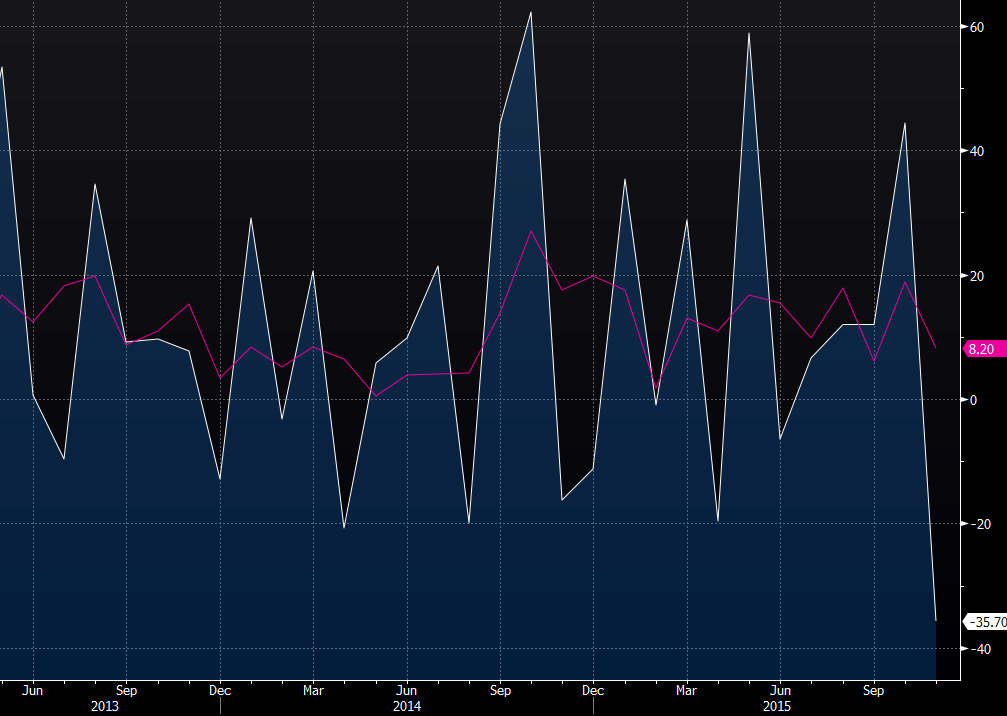

The consensus for Canadian employment is an 8K rise but what's equally important is the full-time/part-time breakdown. Last month, the economy lost 35.7K jobs but it was because of a 72.3K drop in part time coupled with a 36.6K gain in full-time.

As a rule of thumb the market weights full-time jobs at a value of 2:1 versus part time jobs.

There is a wide scope of estimates from economists ranging from +30K to -10K.

Here is the Canadian jobs report with a four-month moving average.