The FOMC minutes show a total disregard for the signals markets are sending about disinflation. Five year breakeven rates are plunging, implying that 1.09% average inflation over that period.

The Fed discussed this problem of signaling rate hikes while the market signals disinflation in the Dec 16-17 FOMC minutes and had this to say.

Participants discussed various explanations for the decline in market-based measures, including a fall in expected future inflation, reductions in inflation risk premiums, and higher liquidity and other premiums that might be influencing the prices of Treasury Inflation-Protected Securities and inflation derivatives. Model-based decompositions of inflation compensation seemed to support the message from surveys that longer-term inflation expectations had remained stable, although it was observed that these results were sensitive to the assumptions underlying the particular models used.

Instead of listening to the market. The Fed decided to listen to its models — the same kinds of models that assumed house price declines wouldn’t happen or be limited.

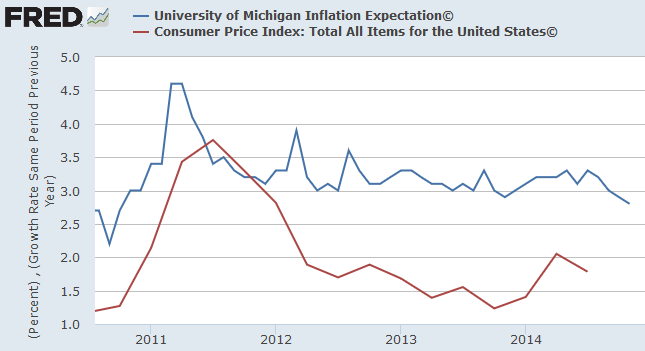

On top of that, Yellen specifically mentioned the University of Michigan survey on inflation expectations, which has overestimated inflation by 200 basis points for the past three years.

U Mich vs reality

The Fed didn’t draw an firm conclusions but “participants generally agreed that it would take more time and analysis to draw definitive conclusions regarding the recent behavior of inflation compensation.”

However, at least a few Fed members queued in that markets might be ahead of the curve, not them.

Some participants were worried that the recent substantial fall in energy prices could lead to a reduction in longer-term inflation expectations, while others were concerned that the decline in market-based measures of inflation compensation might reflect, in part, that such a decline had already begun.