June 2021 FOMC meeting

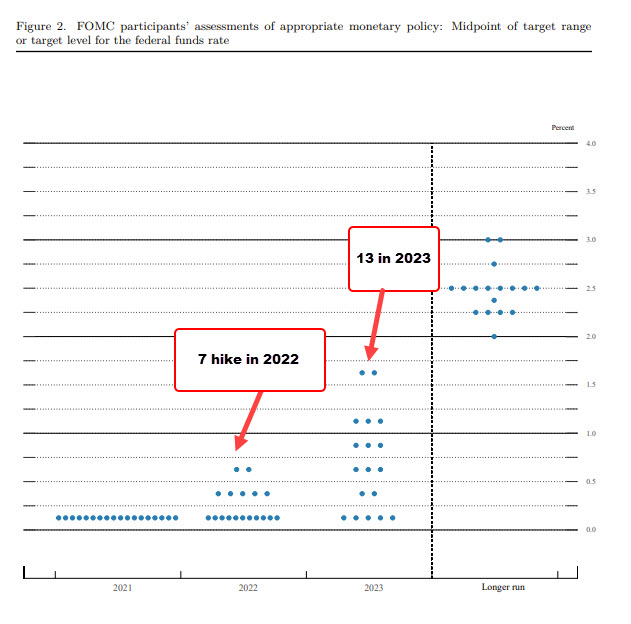

Dot Plot:

The dot plot for the June FOMC meeting shows:

- 7 fed officials see hikes in 2022

- 13 fed official see hikes in 2023.

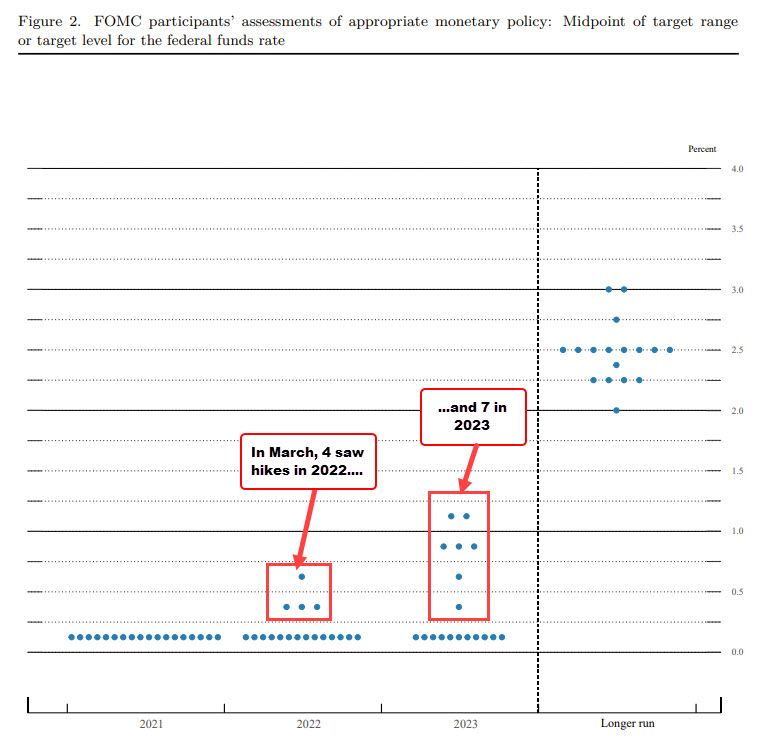

Below is the dot plot from the March meeting. At the time, 4 Fed officials expecting hikes in 2022 and 7 Fed officials in 2023.

Central Tendencies June 2021:

Central Tendencies for 2021:

- GDP 6.8% to 7.3% vs.5.8% to 6.6% in March. GDP HIGHER

- Unemployment 4.4% to 4.8% vs 4.2% to 4.7% in March. Unemployment rate marginally higher.

- PCE 3.1% to 3.5% vs 2.2% to 2.4% in March. Inflation much higher.

- Core PCE 2.9% vs 3.1% vs 2.0% to 2.3% in March. Core inflation much higher.

Central Tendencies for 2022:

- GDP 2.8% to 3.8% to 3.0% to 3.8% in March. Growth near unchanged.

- Unemployment 3.5% to4.0% vs 3.6% to 4.0% in March. Employment near unchanged

- PCE 1.9% to 2.3% vs 1.8% to 2.1% in March. Inflation marginally higher.

- Core PCE 1.9% to 2.3% vs. 1.9% to 2.1% in March. Core unchanged.

Highlights:

- More Fed officials say higher rates in 2022 (from 4 to 7)

- GDP much higher in 2021

- Headline inflation and core inflation also much higher in 2021

- 2022 central tendencies are near unchanged from March estimates