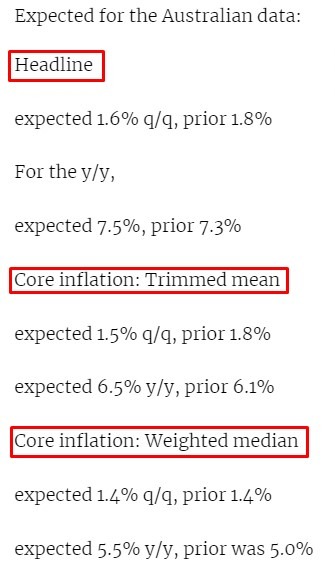

A snippet from SG on the data due from Australia at 11.30am local time (0030 GMT, which is 1930 US ET) and implications for the Reserve Bank of Australia:

- Both headline and core (i.e., trimmed mean) inflation are likely to have risen further in December, which would also lead to an increase in quarterly inflation during 4Q22. The rise in electricity prices that is reflected in CPI only on a quarterly basis (March, June, September and December) will boost the headline inflation figure in December, despite the reduction of automotive fuel inflation (led by the decline in crude oil prices) and housing inflation (driven by housing market weakness that is weighing on new dwelling purchase prices).

- Trimmed mean inflation will also likely rise a bit in December, reflecting the broad-based inflation pressures seen in the Australian economy.

- If our forecasts for the December inflation figures are correct, it means that the quarterly inflation in 4Q is higher than 3Q, both in terms of headline and trimmed mean inflation. If it is confirmed that inflation continued to increase until the end of 2022, it will support further tightening measures by the RBA, which argues that inflation has yet to peak in Australia (while the peak of headline inflation has already been confirmed in quite few countries, including the US).

Earlier: