The Australian Bureau of Statistics will be publishing CPI data for the October - December quarter on Wednesday, 25 January 2023 at 11.30 am local time in Sydney:

- 0030 GMT on Wednesday, 25 January 2023

- 1930 US ET

I posted this yesterday:

Priors and expected:

Headline

expected 1.6% q/q, prior 1.8%

For the y/y,

expected 7.5%, prior 7.3%

Core inflation : Trimmed mean

expected 1.5% q/q, prior 1.8%

expected 6.5% y/y, prior 6.1%

Core inflation: Weighted median

expected 1.4% q/q, prior 1.4%

expected 5.5% y/y, prior was 5.0%

---

Preview comments in brief from Westpac:

The Trimmed Mean is forecast to lift 1.6% in December, a moderation from the 1.8% gain in September which we are forecasting to be the largest quarterly rise this cycle.

The annual pace for the Trimmed Mean is set to lift to 6.6%yr, from 6.1%yr in September, which again is our forecast peak in core inflation. We are forecasting core inflation to moderate to 3.4%yr by end 2023.

The key factors in our forecasts are:

- ongoing robust gains in food prices,

- rising fuel prices due to the increase in fuel excise,

- and a bounce back in holiday travel prices

As for the RBA, Westpac are forecasting a 25bp rate hike at the next meeting, February 7. And tipping further hikes ahead until a p[eak in May.

--

Preview comments via Scotia:

- The addition of monthly CPI inflation readings since October has sharply improved the freshness of readings that were previously largely reliant upon lagging quarterly estimates.

- Australia updates both for Q4 and December on Tuesday evening (eastern time as always).

- Markets trimmed RBA bets a bit after a small part-time driven drop in employment during December and may be more vulnerable to upside surprise to inflation relative to what is priced.

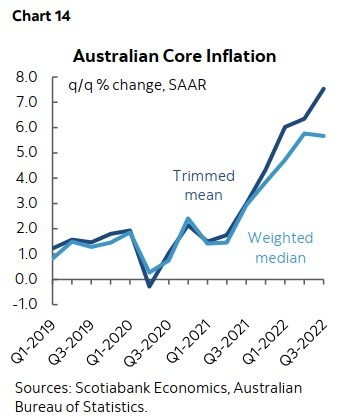

- Headline CPI is expected to accelerate toward 7 ½% y/y in Q4 and 7.7% y/y in December with trimmed mean CPI expected to approach almost 6% y/y. Quarter-over-quarter momentum will be key given the pattern to date (chart 14)

Graph via Scotia's preview: