Bank of Japan monetary policy meeting for June 2022 has concluded.

Main points:

- maintains 10-year JGB yield target at about 0%

- maintains policy balance rate at -0.1%

More:

- BOJ repeats April guidance of offering to buy 10-year JGBs at 0.25% every business day unless it is highly likely no bids will be submitted

- Leaves unchanged its guidance on policy bias, says will take additional easing steps without hesitation as needed with eye on pandemic's impact on economy

- Leaves unchanged its forward guidance on interest rates, says expects short- and long-term policy rates to remain at 'present or lower' levels

- Must carefully watch impact of forex moves on Japan's economy, prices

- exports and output continue to rise as a trend but the impact of supply constraints is rising

- Japan's consumer inflation to move around 2% for the time being, but narrow pace of increase after

More:

- Japan's economy picking up as a trend, though some weakness has been seen

- Japan's inflation expectations, particularly short-term ones, have risen

- Japan's exports, output have continued to increase as trend but effects of supply-side constraints have intensified

- Japan's core consumer inflation has been at around 2%, mainly due to rises in energy and food prices

- Japan's economy is likely to recover with impact of COVID and supply-side constraints waning

- Japan's core consumer inflation is likely to be around 2% for the time being but is expected to decelerate thereafter

more to come

--------------

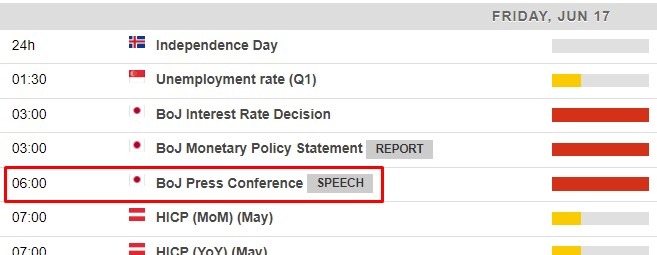

Still to come from the BOJ, Kuroda's press conference: