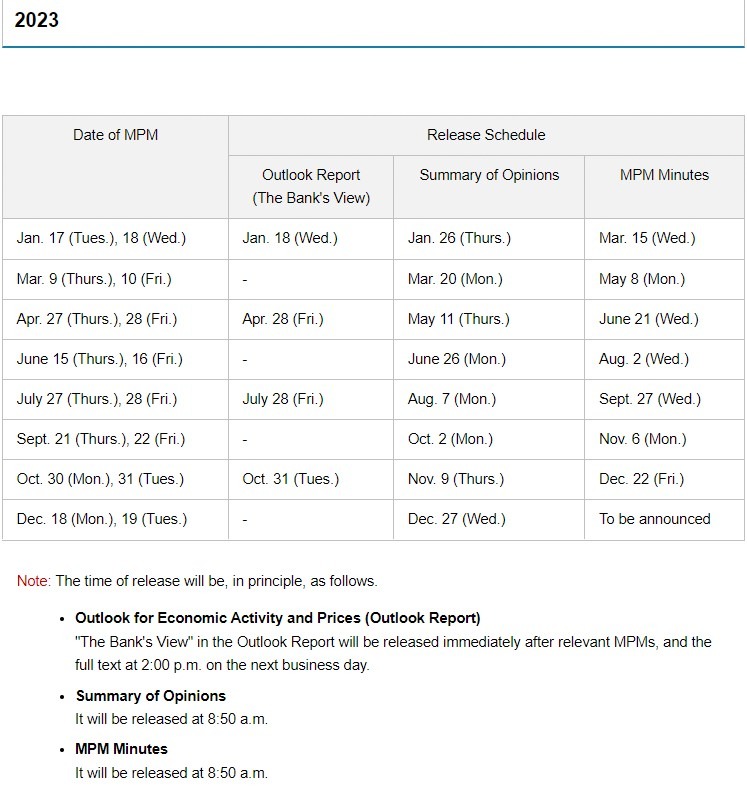

At next week's Bank of Japan policy meeting we'll get an update to the Bank's "Outlook" report, which includes CPI forecasts:

Reutersreport, citing JiJi media in Japan:

- The Bank of Japan is considering a projection for consumer prices for the 2025 fiscal year to rise 1.6-1.9%, the Jiji news agency reported on Monday, in a move seen to keep market players from betting on the central bank to head to exit from stimulus.

- It was not immediately clear whether Jiji was referring to core consumer prices or narrower gauge of inflation .

Next week's policy meeting is the first under new Governor Ueda, and the report cites an analyst as saying:

- "If the BOJ board members' median estimate reaches 2% in fiscal 2025, that would prompt market players to factor in the end of easing let alone negative interest rate policy," said Izuru Kato, chief economist at Totan Research. "Governor Ueda doesn't want it to happen at his debut policy setting meeting on April 27-28," Kato said.

---

The Bank of Japan seems to have boxed itself into an unhelpful communications policy with markets, as I posted earlier today, and well before today also:

- new BoJ deputy Governor Uchida underlined that any further YCC adjustments should not be communicated to the market prior to any adjustment

- You'll recall the huge global market disruption when former Bank of Japan Governor Kuroda widened the JGB yield band at the December meeting. If the BOJ indeed insists on surprising again they are setting the markets up for further volatility.