Japanese GDP data for January - March was printed earlier in the session, it showed a solid beat indeed:

ING remarks, including the implication they see for the Bank of Japan Nune meeting:

- The easing of covid restrictions including border opening seems to have boosted consumption and investment, but weak global demand weighed on exports.

- Today’s stronger-than-expected GDP outcome supports our view that the BoJ will take a step toward normalization before long.

- Japan’s economy appears to be on a gradual recovery track despite sluggish global demand. Also, yesterday, the Japanese government approved an electricity bill rise from June, which is expected to keep inflation above 2% for longer than expected. We will need to revise our inflation forecast higher. Although this is mainly cost push inflation, it will still drive up core inflation to some extent as well.

- Thus, with higher than usual wage growth this year, the BoJ will probably revise its YCC policy at the upcoming June BoJ meeting.

---

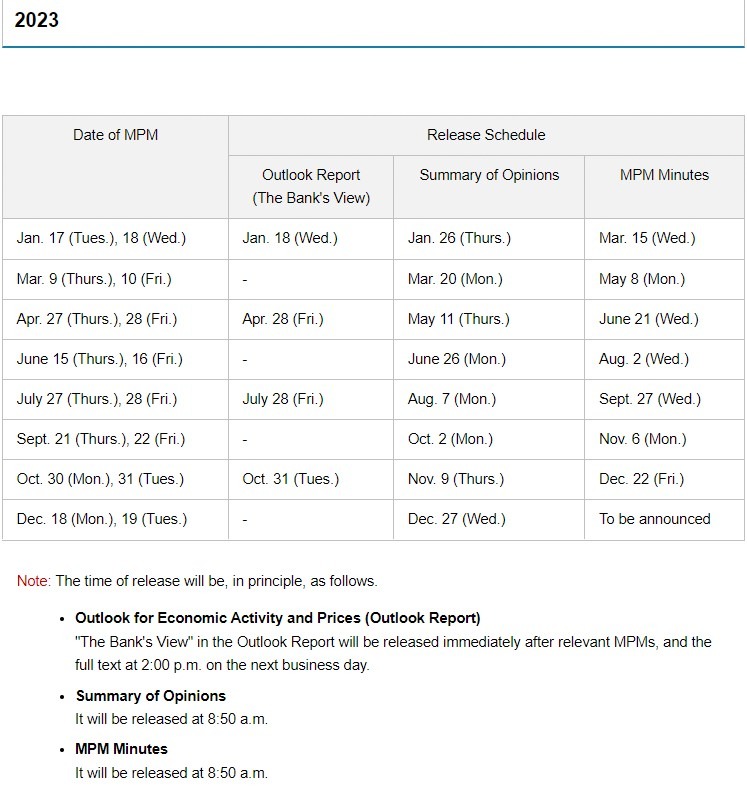

The next BOJ meeting is June 15 and 16: