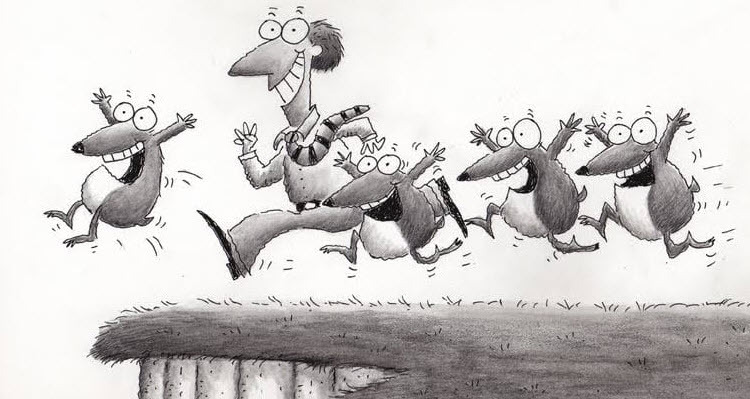

There are hundreds of decision-making central bankers in the world and thousands of employees advising them but time after time they prove that they only think with one collective mind.

The collective groupthink at central banks is an ongoing disaster. It means that any collective mistake is amplified across the globe.

At the dawn of the pandemic that meant central banks together rolling out enormous QE packages, including the Fed pledging 'unlimited' purchases that reached $300 billion per day.

That was followed by promises to keep rates zeroed out (or lower) for many years. Less than a year ago, the RBA was till promising not to lift rates from 0.1% until 2024. That flawed guidance inflated many bubbles, including in Australian housing.

That was followed by a collective belief that inflation was 'transitory', something that was repeated ad nauseum at this time last year, including Powell at Jackson Hole.

That was followed by a hasty retreat and now a sloppy series of disruptive rate hikes.

There should have been some kind of reckoning but the same leaders are doing it again. Now at the alter of groupthink is the message that rates must be jacked up even in the face of a recession in order to anchor inflation expectations. The idea is that the public needs to take the rate medicine now or risk a worse inflation infection later.

We've heard just about every Fed member say that now and it was followed by the ECB's Schnable at Jackson Hole who succinctly outlined the new ethos:

"Even if we enter a recession, we have little choice but to continue the normalization path ... If there was a de-anchoring of inflation expectations, the effect on the economy would be even worse."

Today it was the BOE's Mann and I'm sure that when the BOC, RBA and ECB hike rates this week, they'll all be singing from the same choirbook.

Maybe they're right. Certainly no one wants a repeat of the 1970s, which is the inflation ghost they're fighting against.

What's so troublesome is that no one I can find -- at least publicly -- is pushing for anything else. What happened to that transitory thinking? Gasoline prices are down and supply chains are loosening. To even talk about it is now taboo.

I don't know the answer but looking at central banks' track records of unsucessful groupthink, I'm worried they're going to hold rates too high for too long and unnecessarily cripple the global economy.