- Prior was 5.25-5.50%

- QT pace $25 billion vs $60 billion ($30 billion was expected)

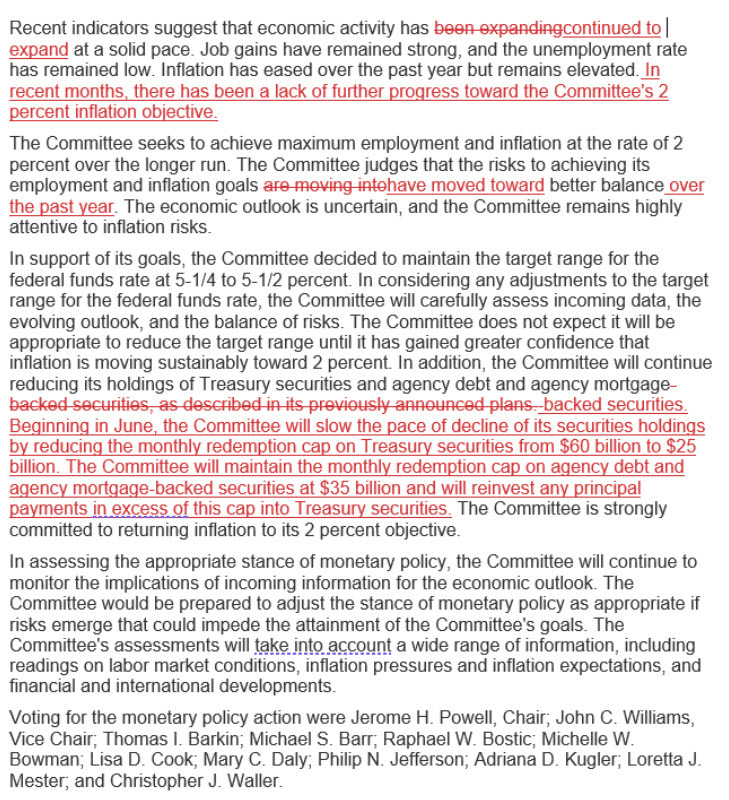

- Economic activity described as 'continued to expand at a solid pace' vs 'expanding at a solid pace' prior

- Jobs gains described as 'have remained strong' vs 'have remained strong' prior

- Inflation described as 'remains elevated' vs 'remains elevated' prior

- Adds line to say 'In recent months, there has been a lack of further progress toward the Committee's 2 percent inflation objective.'

- The Committee judges that the risks to achieving its employment and inflation goals have moved toward better balance over the past year

The statement repeated:

The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.

The market was pricing in 30 bps of easing ahead of the FOMC statement and that's up to 32 bps afterwards with some US dollar selling creeping in. The market was worried about a hawkish shift and there isn't much of one here aside from a nod to inflation being higher. I'd characterize the market reaction so far a sigh of relief.

The WSJ's Nick Timiraos wrote:

The Fed marked to market its policy statement to acknowledge recent inflation setbacks, but didn't change the guidance section

Chairman Jerome Powell will speak in a press conference at 2:30 pm ET.

Redline from ZeroHedge: