Signs of an economic slowdown are here but what will move markets on the FOMC decision are signs of a slowdown in the pace of rate hikes.

The market can get laser-focused on the small difference between 75 basis points and 100 basis points but what ultimately matters is the terminal destination of rates. Right now, the Fed funds futures market is pricing in a top at 3.38% in Dec/Feb and then declining to 2.88% by November 2023.

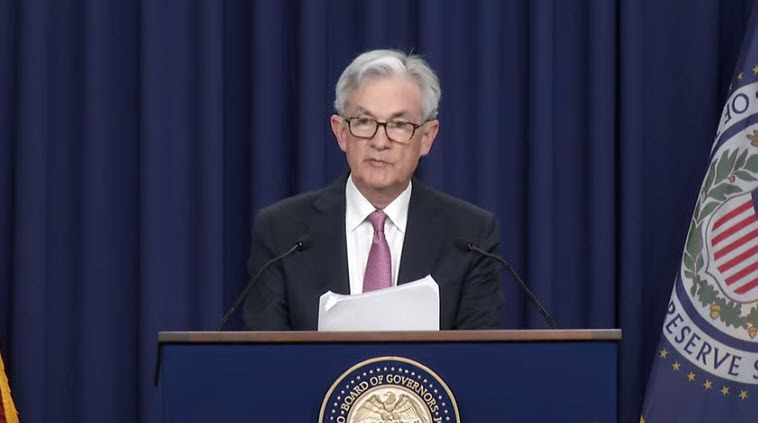

What I will be looking for at the Wednesday, July 27, 20022 FOMC decision are signs that the shape of that Fed funds curve will change.

On the hawkish side that could mean signals that rates will be held at high levels for longer, pushing up the November 2023 level back above 3%.

That may be tough for the Fed to do because the credibility of officials beyond a few months is stretched.

On the dovish side the Fed could recognize signs that growth is stumbling. With that, it will bring downward pressure on inflation and may ultimately validate the ‘transitory’ narrative coming out of the pandemic, though certainly on a longer, stronger scale.

Don’t look for the Fed to say anything explicit, like that they see a peak in inflation. The Fed is missing its mandate on price stability badly with inflation at 9.1% y/y and the failure to foresee rising prices or act quickly enough has left it wounded politically.

The risk is that they now tighten too much, too fast and needlessly punish the economy with a harsh recession when prices were already falling.

Great evidence of that came on Monday from Wal-Mart, who lowered corporate guidance and said spending was shifting to food from goods.

“This is affecting customers’ ability to spend on general merchandise categories and requiring more markdowns to move through the inventory, particularly apparel,” the company said in the release.

It’s not a unique situation. Companies in many categories of consumer goods have too much inventory and will be lowering prices. US food prices have also stabilized and gasoline prices are down more than 10% in the past 30 days.

I could make a compelling case that inflation has peaked here and will drift lower through year end and into 2023.

What’s harder to predict is where it will stabilize. Will it be 2%, or 4%?

The Fed will be struggling with that question but a big input will be demand. On Thursday, the Q2 GDP report is due and is expected at +0.5%, narrowly avoiding a second consecutive quarter of negative GDP and a technical recession.

Fed policymakers will be quick to dismiss that because of the effects of inventories and other one-offs, but they are attuned the potential for a real recession starting late this year.

What’s important to note is that so far Fed policymakers have dismissed that. But given some recent economic data, that’s getting tougher to do. There are signs of very rapid slowing in housing, which is one of the areas most-sensitive to Fed rate hikes. That kind of pain will show up elsewhere in time as well.

Comments from the two leading Fed hawks – Waller and Bullard – indicate their models show rates peaking at 3.75% but that’s in a scenario of ongoing positive growth.

"I personally think some of the fears of a recession are kind of overblown," Waller said July 7.

“We've got a good chance at a soft landing,” Bullard said the same day.

What happens when Fed officials see evidence of rapidly-slowing growth?

We may be about to find out. In all likelihood, it means they shift to a slower pace of rate hikes or more of a wait-and-see mode. That could mean ratcheting all the way down to 25 bps in Sept vs the 50 bps that more-than priced in right now. Or it could mean another 75 bps in Sept and then a full pause.

“I expect hikes to continue after July at a pace that's dependent on incoming data,” Waller said in early July.

That kind of shift from Powell and the Fed, or even a hint at open-mindedness to it, may be all markets need to see to sell the US dollar and buy risk assets.