Westpac on the Federal Open Market Committee (FOMC) statement and Powell's press confernce.

In brief:

Two small but significant changes were made to the statement with respect to inflation and the policy outlook

- 1. With annual CPI inflation having decelerated from 9%yr to close to 6%yr between June and December 2022, and we might add now with a six-month annualised pace of 2%, inflation was seen by the Committee as having “eased somewhat” while remaining “elevated”.

- 2. The other change of significance is the focus now being on the “extent of future increases” rather than the “pace” of tightening at December. This small adjustment points to an end of the tightening cycle being near, although the continued use of the “Committee anticipates that ongoing increases in the target range will be appropriate” implies that the baseline peak fed funds expectation of the Committee remains 5.1%, as per their December meeting forecasts, 25bps higher than both the market’s and Westpac’s expectation.

The Q&A discussion of the policy outlook was also finely balanced, with Chair Powell signalling the Committee has more to do, but also that financial conditions are now restrictive, with real interest rates positive across the curve.

--

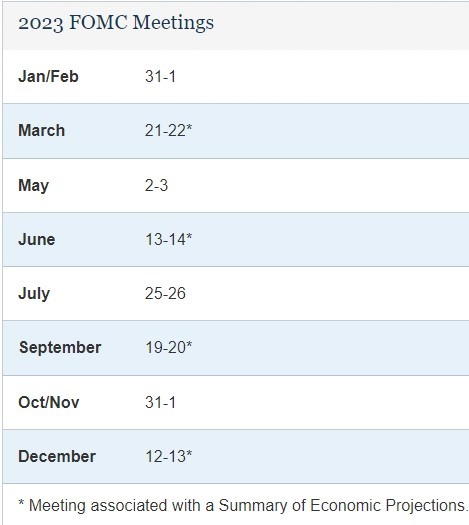

Overall, we remain of the view that the FOMC is most likely to end this tightening cycle at the March meeting with one further 25bp hike before going on hold at 4.875% for the remainder of 2023. However, depending on developments in financial conditions and services inflation, they may feel a need to continue the current pace of tightening to the May meeting.